#CashlessConsumer We updated #DisasterPayments tracker with #PayTM helping hand links. PayTM support 9 funds.

https://docs.google.com/spreadsheets/d/1gTrGvX6HfGfd4zkfm7ctMgUBNwo6DhNUNvz5n5KVbw4/edit#gid=0

CashlessConsumer is a consumer collective working on digital payments to increase awareness, understand technology, produce /consume data, represent consumers in policy surrounding digital payments

Toot archive of all toots by Cashless Consumer

#CashlessConsumer We updated #DisasterPayments tracker with #PayTM helping hand links. PayTM support 9 funds.

https://docs.google.com/spreadsheets/d/1gTrGvX6HfGfd4zkfm7ctMgUBNwo6DhNUNvz5n5KVbw4/edit#gid=0

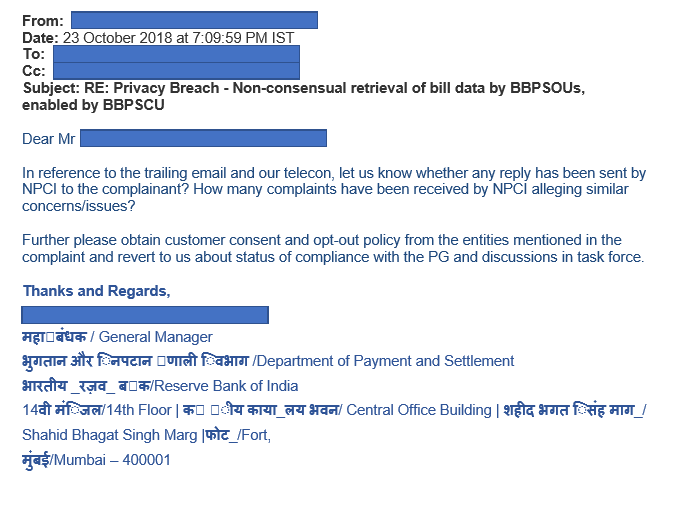

The violations meanwhile keep continuing. The followup to the complaint in Oct 2018 was made last month - https://medium.com/cashlessconsumer/following-up-on-consent-less-auto-fetch-privacy-violations-in-bbps-500ecc27fa30 #CashlessConsumer #Privacy #CreditScoring #DataEconomy

BBPSCU asked specific instances of agent violating consent.

https://twitter.com/BharatBillPay/status/1247801765149282305

NPCI responded saying it had incidentally formed a steering committee on recurring bill payments with the same very same offenders mentioned in the complaint.

It is to be noted, #NPCI till date has not replied to the follow up on complaint.

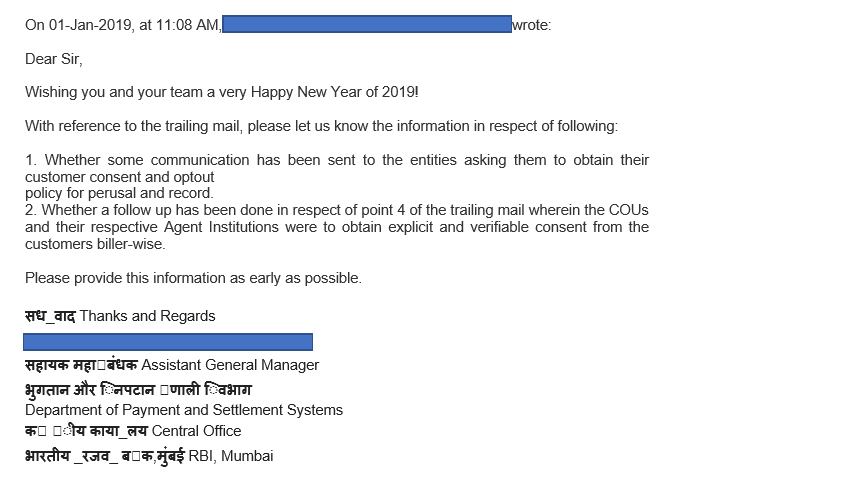

#CashlessConsumer We asked #RBI about its action towards the #BBPSPrivacyBreach complaint and they had responded with series of emails from RBI to NPCI with name / EMail IDs masked.

Lockdown will not impact payments - Dilip Asbe of NPCI.

http://toi.in/v1QFSY/a24gk via @timesofindia

#CashlessConsumer Biometric authentication to withdraw cash sees only a minor drop despite nationwide lockdown #AePS #COVID19 #DBT

https://www.medianama.com/2020/04/223-biometric-authentication-aeps-march/

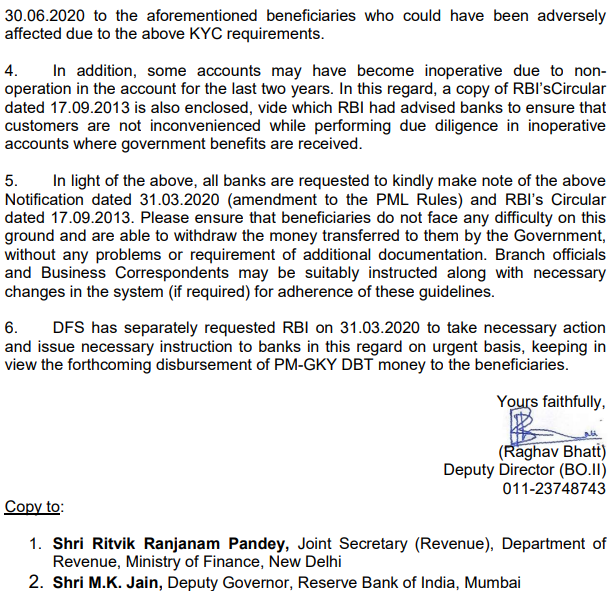

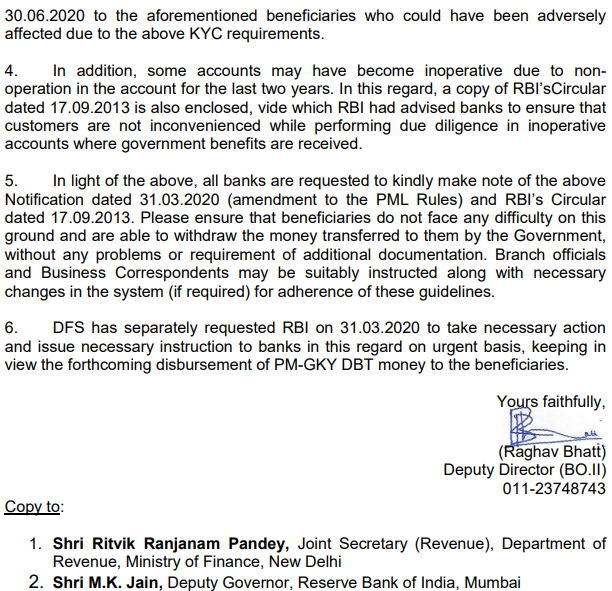

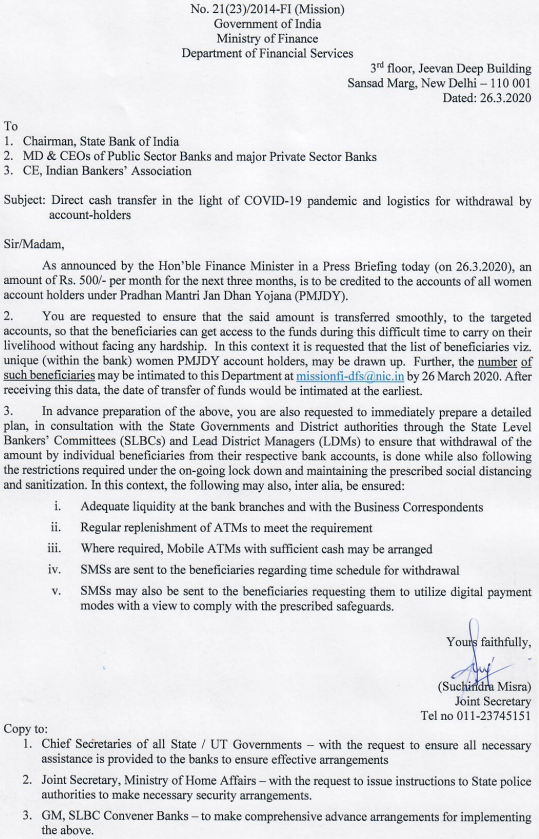

#CashlessConsumer - #DFS letter on relaxation of OVD requirements for opening a small account / KYC formalities of #PMJDY accounts, citing amendment to #PMLA rules relaxing strict KYC requirements to help poor. #PMGKY #DBT #COVID19

Sebi extends second phase of #UPI implementation for retail investors till further notice https://www.outlookindia.com/newsscroll/sebi-extends-second-phase-of-upi-implementation-for-retail-investors-till-further-notice/1785061

As #COVID19 continues to wreck disasters & relief funds have called in for donations, #CashlessConsumer took some time to update our #DisasterPayments tracker -- Happy to note few states digitized CMRF in 2019

#COVID19 #DFS letter to banks on #DBT and logistics for cash withdrawal. https://pdfhost.io/v/bNAEbInFI_DFS_letter_to_banks_260320_on_Cash_logistics_in_COVID19.pdf

But continued use of biometric #AePS only increases risk of #COVID19 transmission & there is an urgent need to increase robustness of last mile cash delivery infrastructure through card issuance, ATM infra, move to card based MicroATMs

https://twitter.com/logic/status/1240600173761441792

#CashlessConsumer #DBT #COVID19 relief -- Business Correspondant operations are exempted under Point E of MHA order.

https://pdfhost.io/v/jAbX6tLGt_MHA_order_with_addendum_to_Guidelines_Dated_2432020pdfpdf.pdf

SBI letter to BC (This was before PM announcement of complete lockdown).

#CashlessConsumer IBA letter to RBI on Mar 13 has sought relaxation / extension on enforcement of placing limits and enabling / disabling card not present (online) / contactless transaction on cards. #DigitalPayments #Security

Debit cardholders who withdraw cash from any bank ATM can do it free of charge, from any other bank’s ATM, for the next three months. Also, there shall not be any minimum balance requirement fee, the FM said.

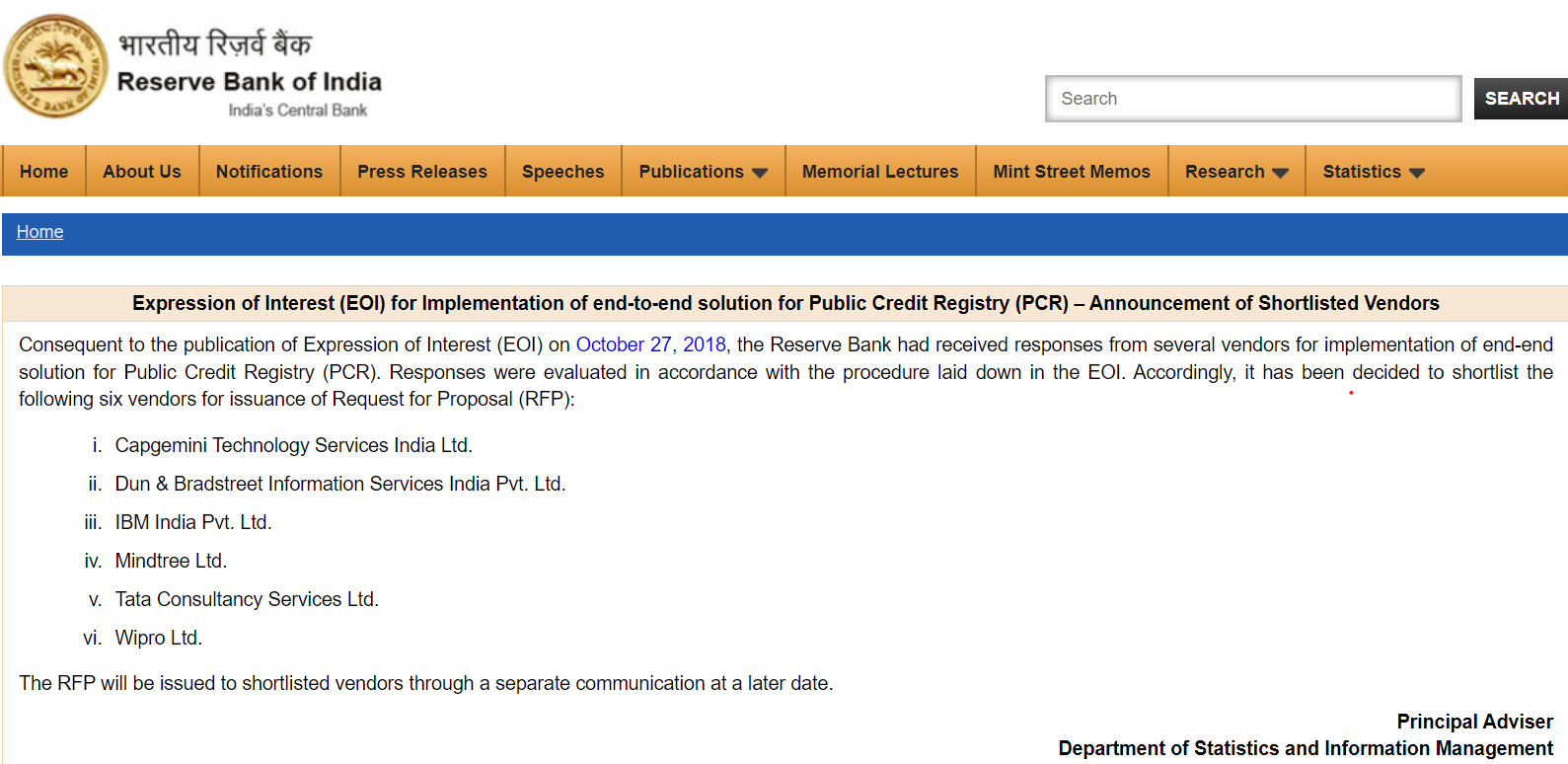

RBI shortlists TCS, Dun & Bradreet to set up #PublicCreditRegistry #PCR

#COVID19 Dept Financial Services, GoI #India letter to SBI / IBA to promote #DigitalPayments and also instructs banks to ensure sanitization awareness for #AePS BCs including biometric readers.

Can going cashless prevent coronavirus spread? Here’s what the WHO wants you to know

No, coronavirus is not a good argument for quitting cash - MIT Technology Review https://www.technologyreview.com/s/615356/coronavirus-contaminated-cash-quarantine/amp

#PaySafeIndia - Don't fall to marketting gimmicks that takes a crisis for their benefit - without any scientific evidence.

Coronavirus (COVID-19) and other viruses can live on keypads and other surfaces for hours. -- #PaySafeIndia - NHS Scotland says this - Wash after using #ATM / #Keypads https://www.youtube.com/watch?v=QZZFoXV5TUo

How to Clean an Ingenico Card Terminal with an Ingenico Card Terminal Cleaning Card - https://www.youtube.com/watch?v=_UmyyZevsZ4

#UPIChalega is cashing in on this and is promoting mobile based social distancing friendly payments using #PaySafeIndia #COVID19

FY20 saw over 50,000 cases of #fraud usage of debit, credit cards https://www.medianama.com/2020/03/223-fraud-cases-credit-debit-cards/ via @medianama

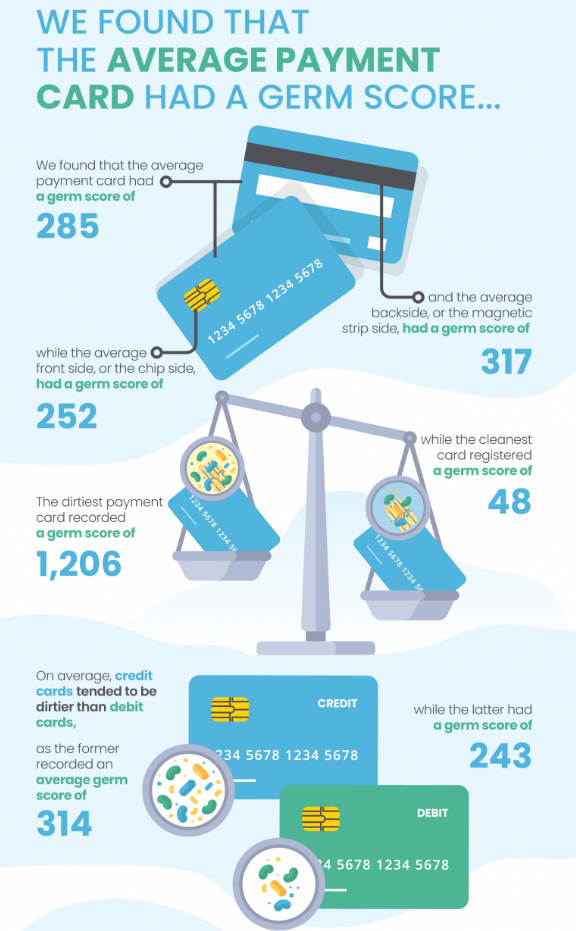

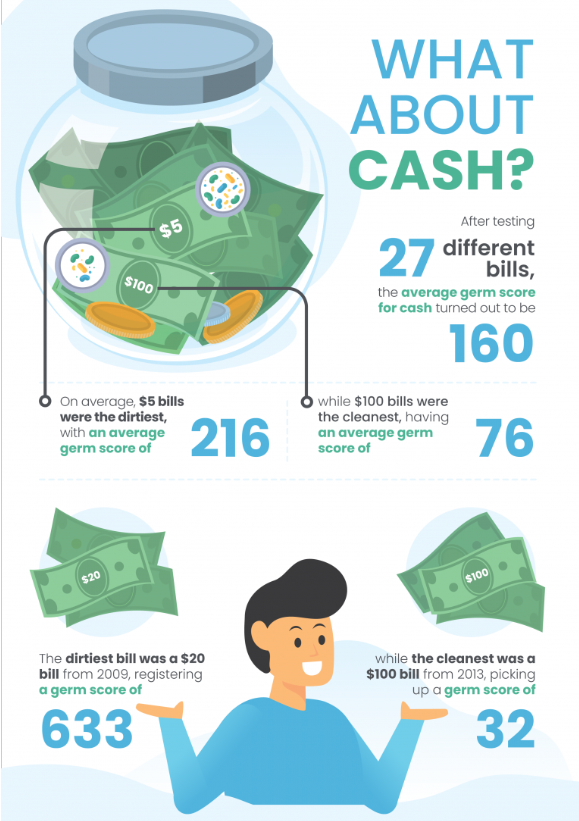

Cash, Cards, Coins -- All of them are dirty -- This is a study done by Newyork based LendEdu

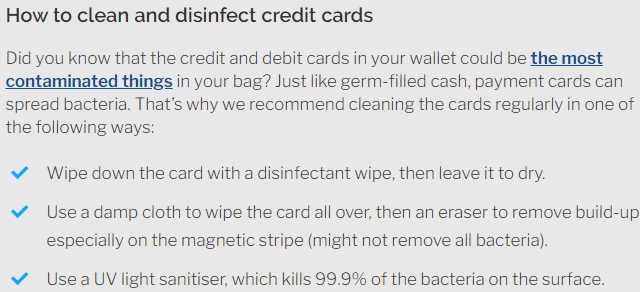

Steps to clean your card -- Don't believe in propoganda that says avoid cash, use cards. Because they are equally susceptible to carry germs.

How to clean #PoS machine: Tips and steps to follow

https://www.mobiletransaction.org/how-to-clean-a-credit-card-machine/ #DigitalPayments

Closer home - #Chennai did sanitization of ATMs

https://www.newindianexpress.com/cities/chennai/2020/mar/16/coronavirus-1826-atm-kiosks-to-be-sanitised-in-chennai-2117215.html

Are ATMs making the coronavirus crisis worse? - https://www.paymentssource.com/news/are-atms-making-the-coronavirus-crisis-worse

//A 2019 study from LendEDU found that the average financial institution’s ATM is cleaner than a McDonald’s door handle but dirtier than a New York City subway pole// Any India studies?

#COVID19 Lack of safety measures in #ATM, #POS centers a cause of concern #DigitalPayments

ICICI Bank launches ‘ICICIStack’, a comprehensive digital banking platform

https://cio.economictimes.indiatimes.com/news/enterprise-services-and-applications/icici-bank-launches-icicistack-a-comprehensive-digital-banking-platform/74674297

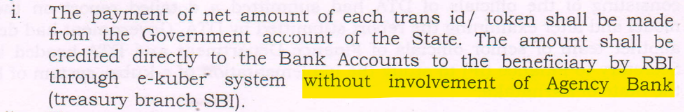

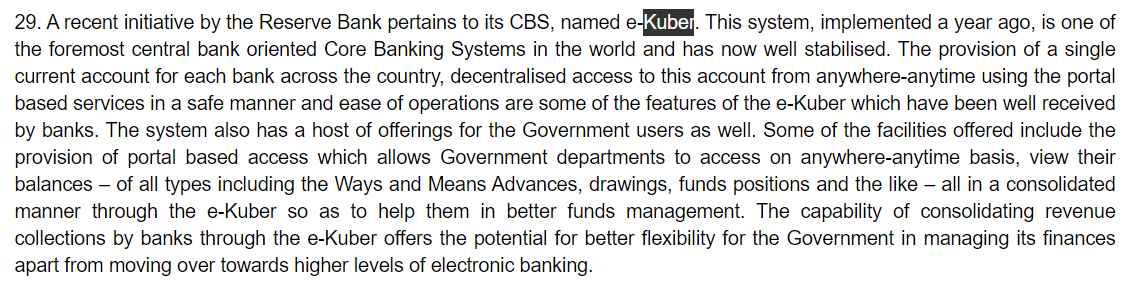

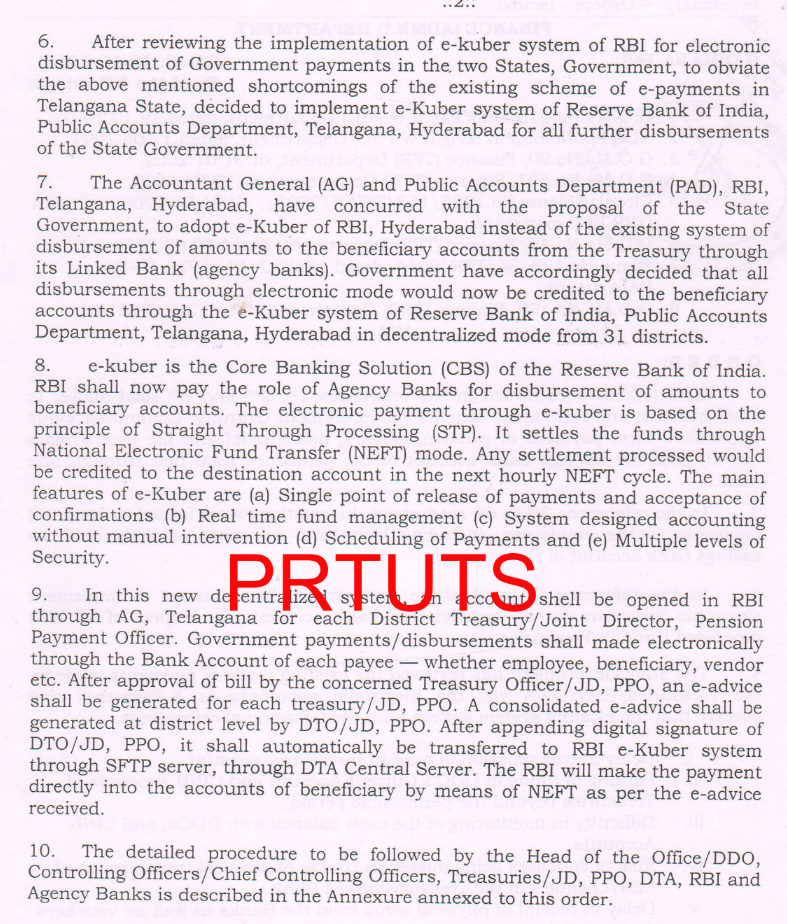

The key difference is #eKuber originating #DBT is a real #DBT at originating end (while still not so direct at recipient end), where as #Aadhaar based #APB is having a central intermediary on top of agency bank and hence has cost of 2 intermediaries & cannot be called true #DBT

HR Khan on #eKuber in 2013 - Challenges and Concerns of the Central Bank: Opportunities and Role for the Commercial Banks - Harun R Khan https://www.rbi.org.in/SCRIPTs/BS_ViewBulletin.aspx?Id=14283

Ref Govt of TS GO on #DBT using #eKuber https://drive.google.com/file/d/1SCEaEfnFQXXzVIB-_M06KlrLNRziuz74/view

Also, reiterating #CashlessConsumer ;s call for #Aadhaarless #G2P #DBT made at #AadhaarTribunal

Beneficiary access still has issues with last mile infrastructure, more recently is susceptible to risks such as moratorium by RBI.

We still don't know transaction success rates, #CashlessConsumer has filed an #RTI with RBI and will update here.

While we are it, its important to note than all bank based #DBT stops with bank account as terminal

#eKuber is fairly old and is being in use since 2015 at least. Kerala govt pays salary through it https://www.thehindu.com/news/cities/Thiruvananthapuram/ekuber-portal/article7828848.ece

#Manipur recently adopted #eKuber based #G2P payments https://www.eastmojo.com/manipur/2020/02/11/e-kuber-to-ease-disbursement-of-govt-payments-manipur-cm

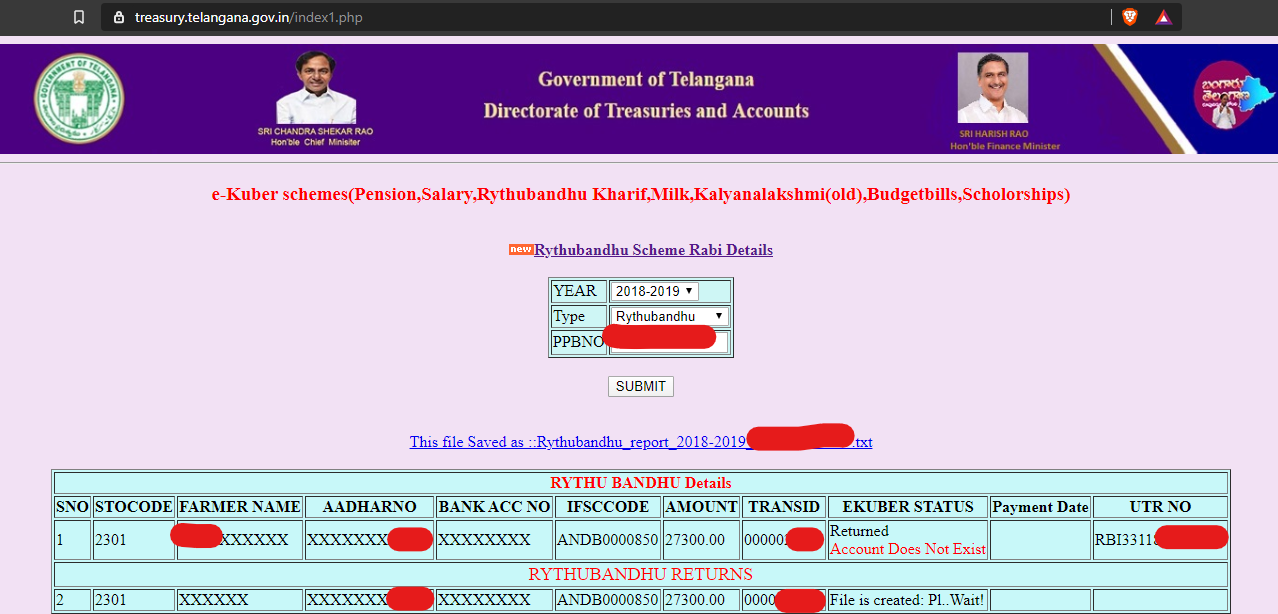

The state in this case, has built a status tracker portal and it gives away details of payment for any grievance redress / transparency.

State's treasury account held at RBI's CBS #eKuber is connected to #NEFT and the payment goes through. Since its #NEFt, there is no upper limit to the transfer. All that is needed is beneficiary's account number and funds in treasury.

What is #eKuber ?

e-Kuber is the Core Banking Solution of Reserve Bank of India. e-Kuber Is being widely used by central and state governments for their financial management.

But how does the payment go through ?

Though Rythu Bandhu (RBS) needs #Aadhaar, the payment takes place without the #APB infrastructure for #DBT, instead tried cheque based disbursal before moving to #DBT from RBI #eKuber

#CashlessConsumer This paper studies the agriculture income support scheme Rythu Bandhu implemented in #Telangana in detail. It has a interesting note on payments. #Thread on #G2PPayments #DBT

https://twitter.com/bhargavizaveri/status/1239426876197625856?s=20

Exactly what Madras HC issued notices on -- But Hyderabad is violating happily.

Madras HC issues notice to govt over discounts to FASTag users

https://www.medianama.com/2020/03/223-madras-hc-discounts-fastag/

Hyderabad Metropolitan Development Authority to penalise lane-crashing non-#FASTag users https://www.newindianexpress.com/cities/hyderabad/2020/mar/14/hyderabad-metropolitan-development-authority-to-penalise-lane-crashing-non-fastag-users-2116482.html via @NewIndianXpress

https://www.thehindu.com/podcast/who-is-afraid-of-cryptocurrenciesthe-hindu-in-focus-podcast/article31051685.ece - #CashlessConsumer @logic did a breakdown / impact of SC judgement on crypto and its impact to payments.

More about #FASTag and its problems http://overdrive.in/news-cars-auto/opinions/more-about-fastag-and-its-problems/

Madras HC Issues Notice On Plea Challenging Special Discounts Offered To #FASTag Holders

Its only surreal that RBI announced (although unofficially in interview) about Dept of Fintech, on the day it inflicted largest 0 day attack on Indian fintech by #YesBankCrisis

Perhaps next time, they will understand fintech better

Equifax MD on #PublicCreditRegistry

#CashlessConsumer Planning to track #RBI 's new Dept of Fintech through #DigitalIsDivine hashtag.

#UPI doubles limit for credit card, mutual fund payments http://toi.in/x-y7-b/a24gk via @timesofindia

#CashlessConsumer #RTI We asked Finance Ministry details of CPIO of NCGTC and status of Annual Report of FY 2018-19. NCGTC PIO responce attached

Making a Case for Wider Acceptance of Rupay via @EntrepreneurIND @aastha516 http://entm.ag/0o51 - RuPay Credit and SBI Cards. - Note in the context of #SBICards IPO

Airtel Payments Bank rolls out Aadhaar enabled payment system #AePS http://www.ecoti.in/DgwLHb via @economictimes

Also, timely reminder that #PDPBill is yet to become real and this is yet another example of your data being made available by systems to enable private profiteering. Your consent doesn't matter.

Provides a brief overview of #BBPS - https://blog.50p.in/97da8dbf1a91

Given this brazen privacy harm (damage of data hoarding / profile building that has already happened) as well as #NUELicensing , it might be right time to redesign #BBPS regulatory / system architecture.

RBI to make more granular payment systems data publicly available to help improve supervision of payment systems & identify abuse / unacceptable market conduct such as this & regulate the industry better as well as a Zero Tolerance policy on abuse

NPCI to put forth a detailed public report on this matter including details related to top entities / agents performing bill fetch requests disproportionate to the payment requests made by them

NPCI to provide list of entities it had imposed penalties for defying the circular and continuing to perform bill fetch / not providing opt out option.

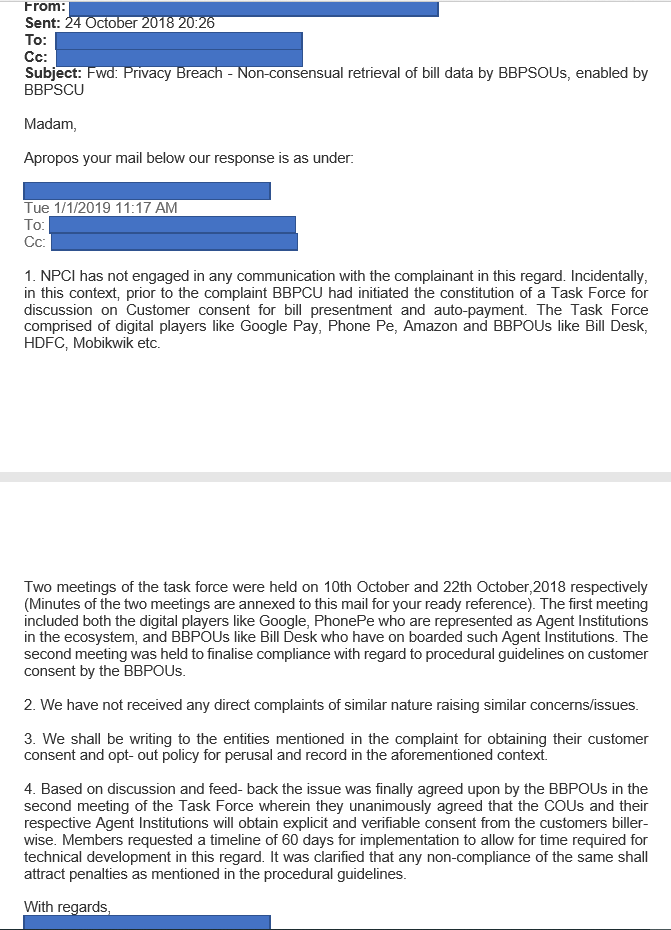

#CashlessConsumer in a followup letter to Board for Regulation and Supervision of Payment and Settlement Systems & CGM DPSS in

RBI as well as CEO, NPCI and Chief of BBPS, NPCI has made the following demands

Every bill payment made via 3rd party app/gateway has to be by regulation mandatorily through BBPS & RBI licensed NPCI as a regulated monopoly for BBPS. #BBPS aggregates household data & it is that is getting accessed by fintech's

https://blog.50p.in/bbps-making-households-data-rich-97da8dbf1a91

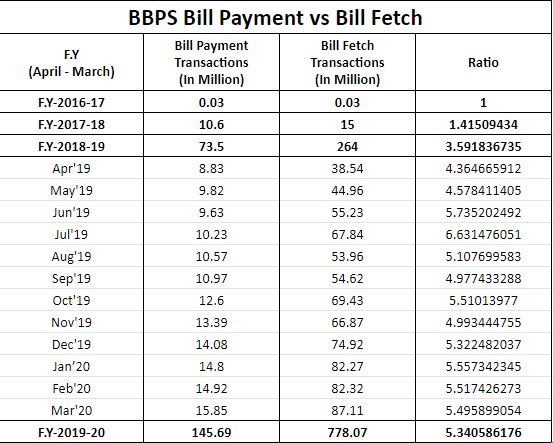

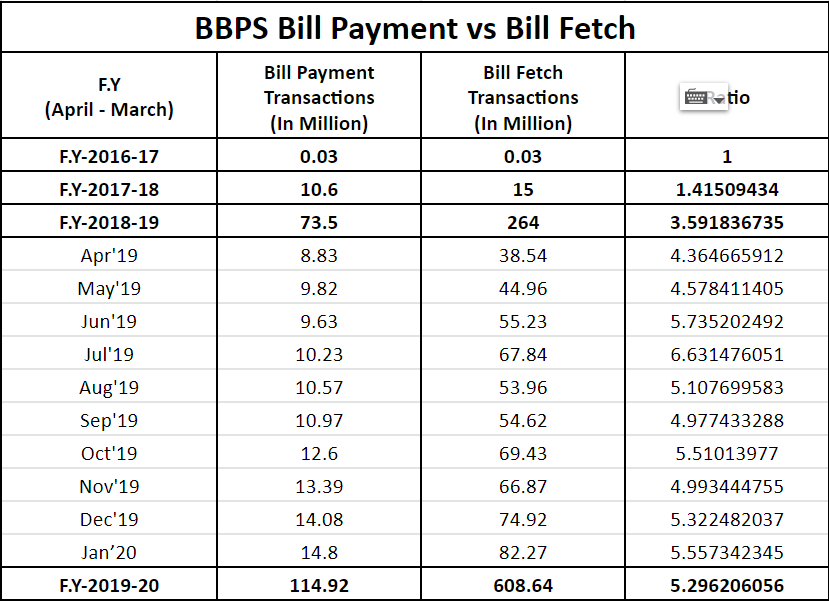

14 months after the circular has to be complied, we see the trend of non-consented bill fetch only growing. It is evident from the data NPCI itself publishes. There is 5x bill fetch to bill payment transactions.

NPCI responded on Nov 1, 2018 with a circular mandating all BBPS ecosystem participants to ensure customer consent for bill fetch and provide opt out of auto fetch provisions and comply with circular in 60 days

In Oct 2018, #CashlessConsumer complained to RBI/NPCI and top fintechs/banks about the privacy abuse in #BBPS for building credit profile database without the consent of individual https://medium.com/cashlessconsumer/2386c9f5296d

#CashlessConsumer Following up on consent-less auto fetch privacy violations in #BBPS

#NPCI's own data shows the practice of building credit profiles continue rampantly completely disregarding user consent & NPCI notice.

Digital payments: Who cares about #MDR? #MDRWars #ZeroMDR https://www.indiatoday.in/magazine/up-front/story/20200309-digital-payments-who-cares-about-mdr-1650540-2020-02-28 via @indiatoday

#CashlessConsumer will be authoring a detailed report on #APB #AePS to document both structural and operational issues in #DBT, provide ground level feedback and seek a full stakeholder dialogue to address delivery infrastructure, focused on payments to improve welfare delivery

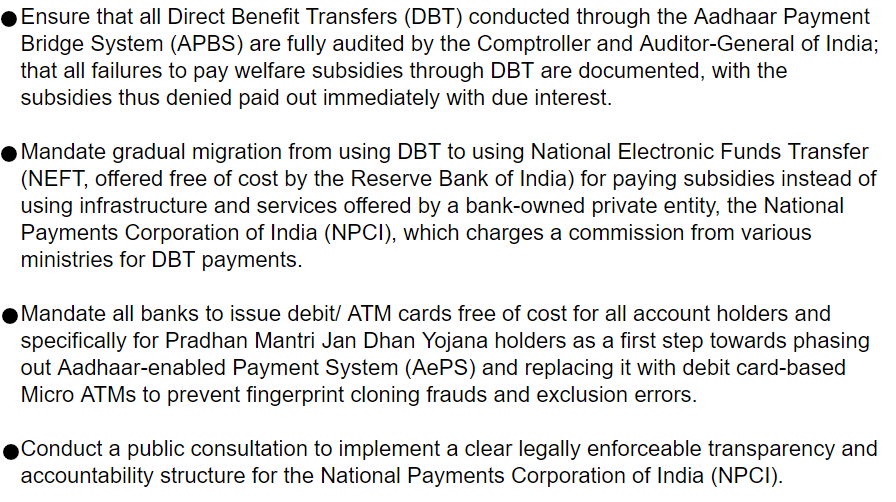

4. Conduct a public consultation to implement a clear legally enforceable transparency & accountability structure for the National Payments Corporation of India. NPCI is delivering a public function of subsidy delivery and has to transparent #RTI and accountable to public.

3. Mandate all banks to issue debit/ ATM cards free of cost for all account holders & specifically for PMJDY holders as a first step towards phasing out #AePS & replacing it with debit card-based Micro ATMs to prevent fingerprint cloning frauds, exclusion errors.

1. A thorough #CAG audit on #DBT infra to officially document the reasons for exclusions (untraceable payments referred in #NITIAayog Poshan report) and detailed report on #APB, compensate the beneficiaries who are denied welfare benefits with interest

#CashlessConsumer @anivar is at #AadhaarTribunal and is talking on intersection of #Aadhaar and #DigitalPayments / #Fintech.

#CashlessConsumer makes the following demands to seek a reform in #DBT / payments infrastructure

Representation to RBI on Draft Framework for authorisation of a pan-India New Umbrella Entity (NUE) for Retail Payment Systems

#NUELicensing @NASSCOMR response https://community.nasscom.in/communities/policy-advocacy/representation-to-rbi-on-draft-framework-for-authorisation-of-a-pan-india-new-umbrella-entity-nue-for-retail-payment-systems.html

Diff shows what #NPCI wanted to hide from public - Pricing of txns. https://draftable.com/compare/towfiPipAKEy

Its anyway irrelevant in context of #ZeroMDR now, but the fact, NPCI took efforts to hide pricing tells so much on #Openness.

NODE paper refers #UPI procedural guideline with link https://www.npci.org.in/sites/default/files/UPI%20Procedural%20Guidelines_29oct19.pdf

while NPCI site was later updated with https://www.npci.org.in/sites/default/files/UPI%20Procedural%20Guidelines.pdf-26112019-onwebsiteLIVE_0.pdf

Its interesting to see the diff.

#CashlessConsumer - Reading NODE - National Open Digital Ecosystems consultation paper authored by BCG and Omidyar Network India https://static.mygov.in/rest/s3fs-public/mygov_158219311451553221.pdf gave an interesting insight on #UPI and openness

https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=19417

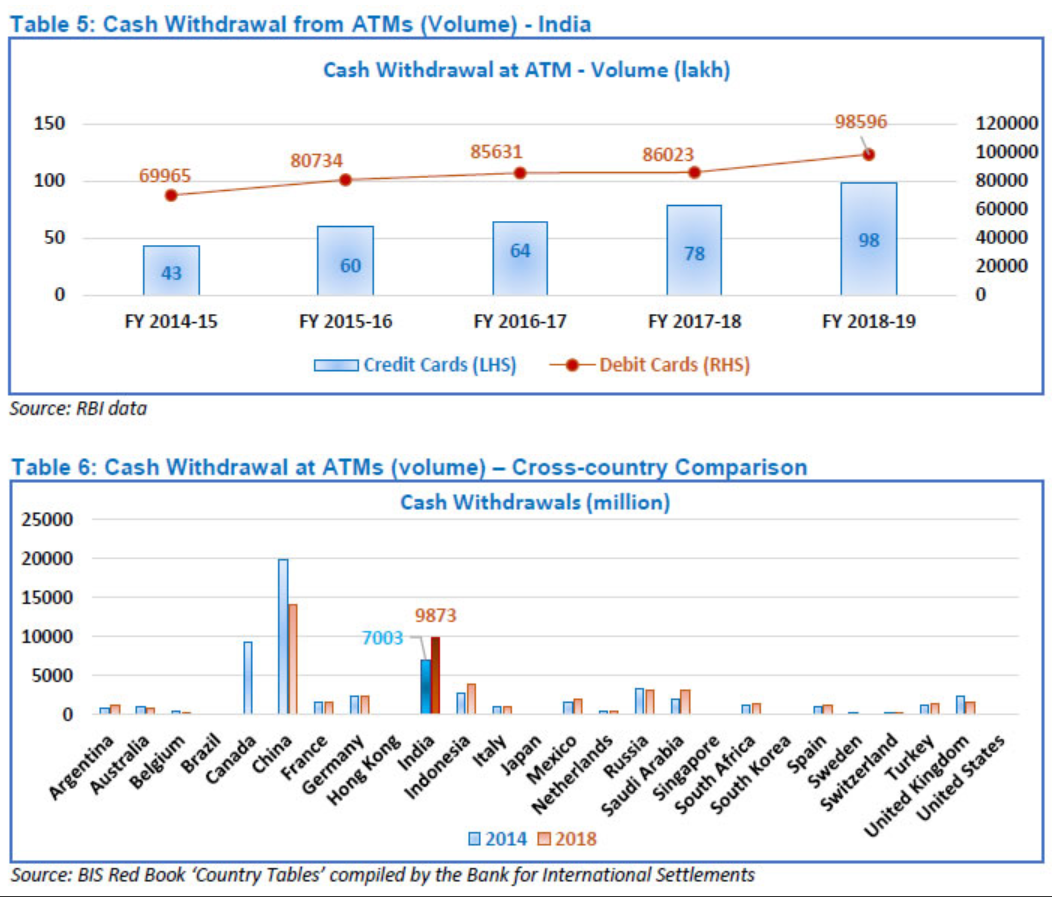

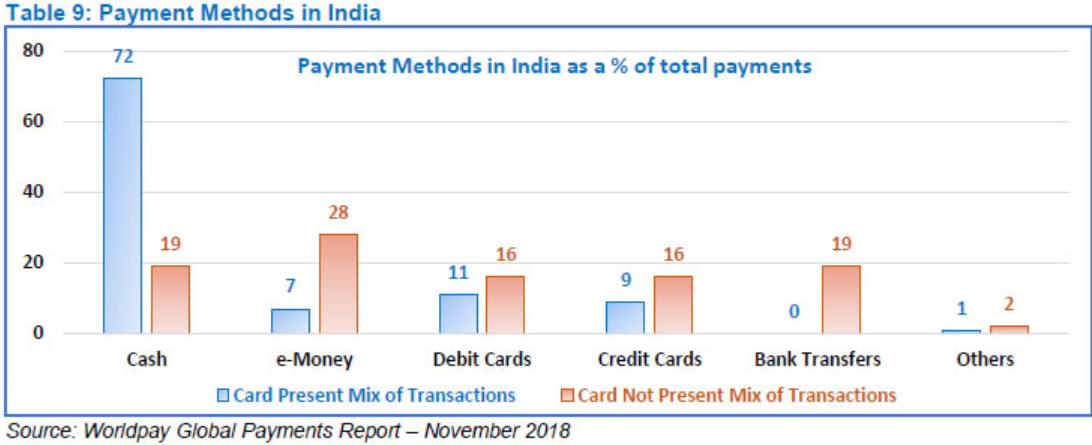

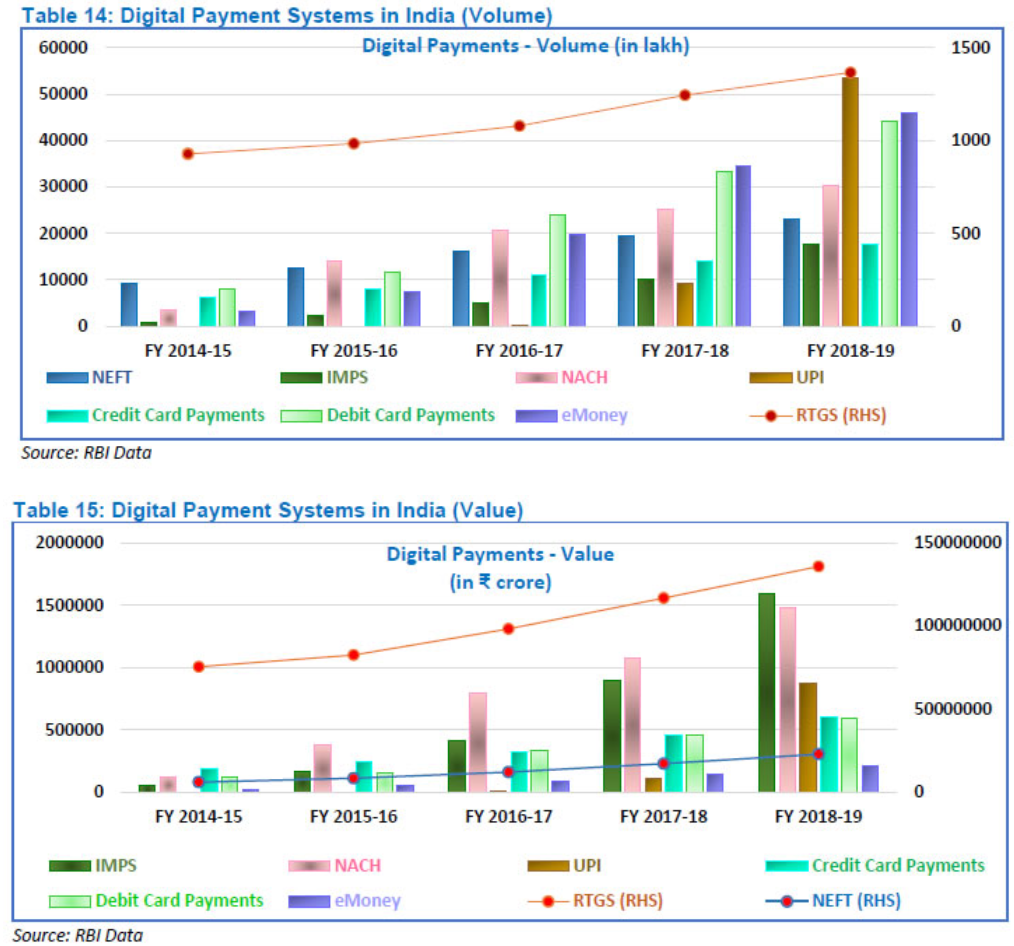

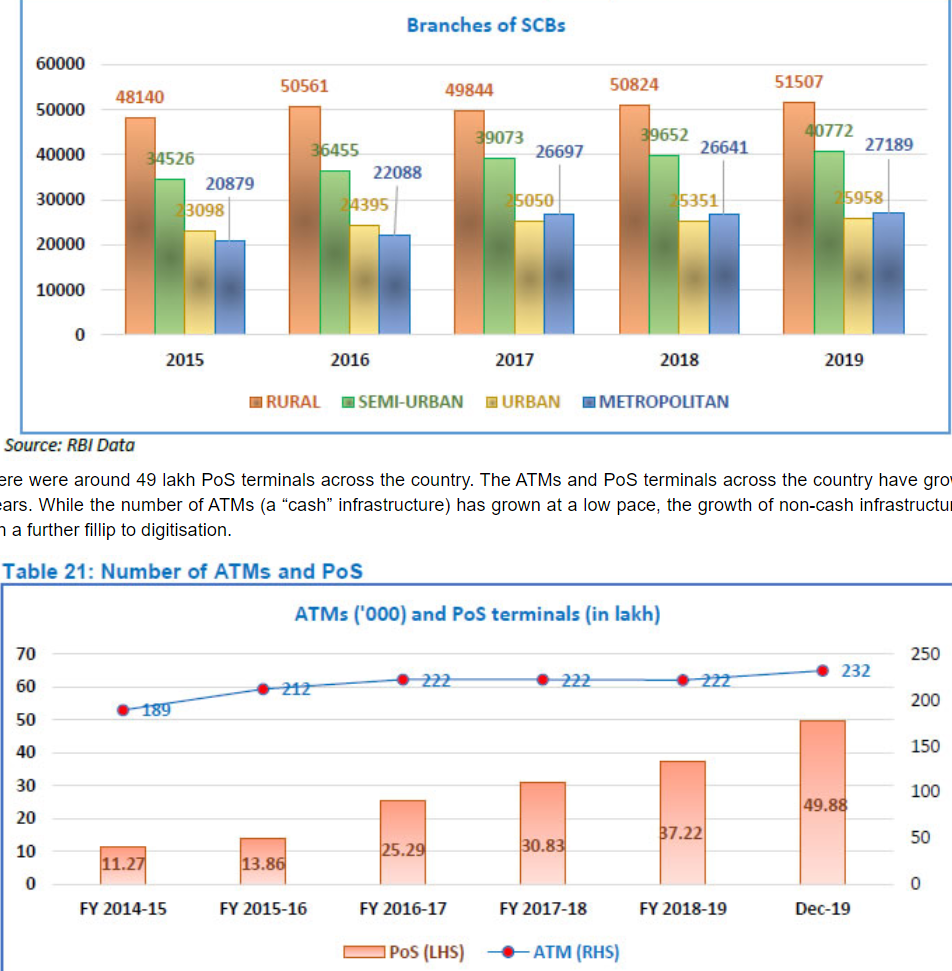

RBI publishes "Assessment of the progress of digitisation from cash to electronic" Some viz from the report.

https://www.thehindubusinessline.com/opinion/editorial/rbi-move-to-create-a-counterpart-to-npci-needs-a-rethink/article30915180.ece A short (hence possibly incomplete) not on #NUELicensing by @businessline editorial, calling it 'somewhat perplexing and needs rethink'

#Policy #CashlessConsumer feedback on RBI's Draft Framework for authorisation of New Umbrella Entity (NUE) for Retail Payment Systems #NUELicensing https://docs.google.com/document/u/1/d/e/2PACX-1vSYbrgKj-pQeKAMk1RZ_3ewjTbbXo75VS9K85kzqaRQN6V_OeDOfen1iDZ0S0-eGXJ0XscRfkODERBM/pub

E-payments industry counts the costs after #ZeroMDR jolt http://toi.in/1ZLhPa/a24gk via @timesofindia

Rivals slam PhonePe's 'ATM' business, question launch in absence of rules http://toi.in/VP5vzY/a24gk via @timesofindia

NPCI's new guidelines for UPI-based cash withdrawal at kirana and local retailers

NPCI stated the guidelines involving a UPI-based cash withdrawal is exactly like the Cash-at-PoS model as permitted by the RBI. However, the only change made is the standardised withdrawal limit.

https://yourstory.com/2020/02/npci-new-guidelines-for-upi-based-cash-withdrawal NPCI's new guidelines for UPI-based cash withdrawal at kirana and local retailers

#FASTag taking toll on commuters

Long queues of vehicles in cashless lanes still order of the day

https://www.tribuneindia.com/news/fastag-taking-toll-on-commuters-42596

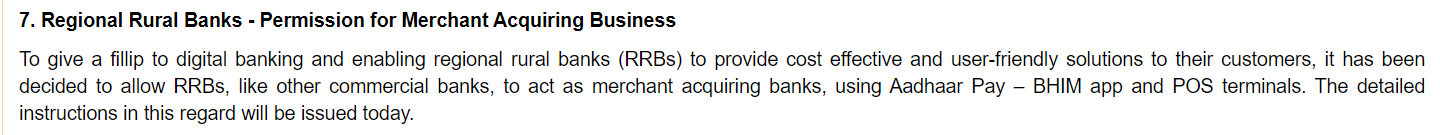

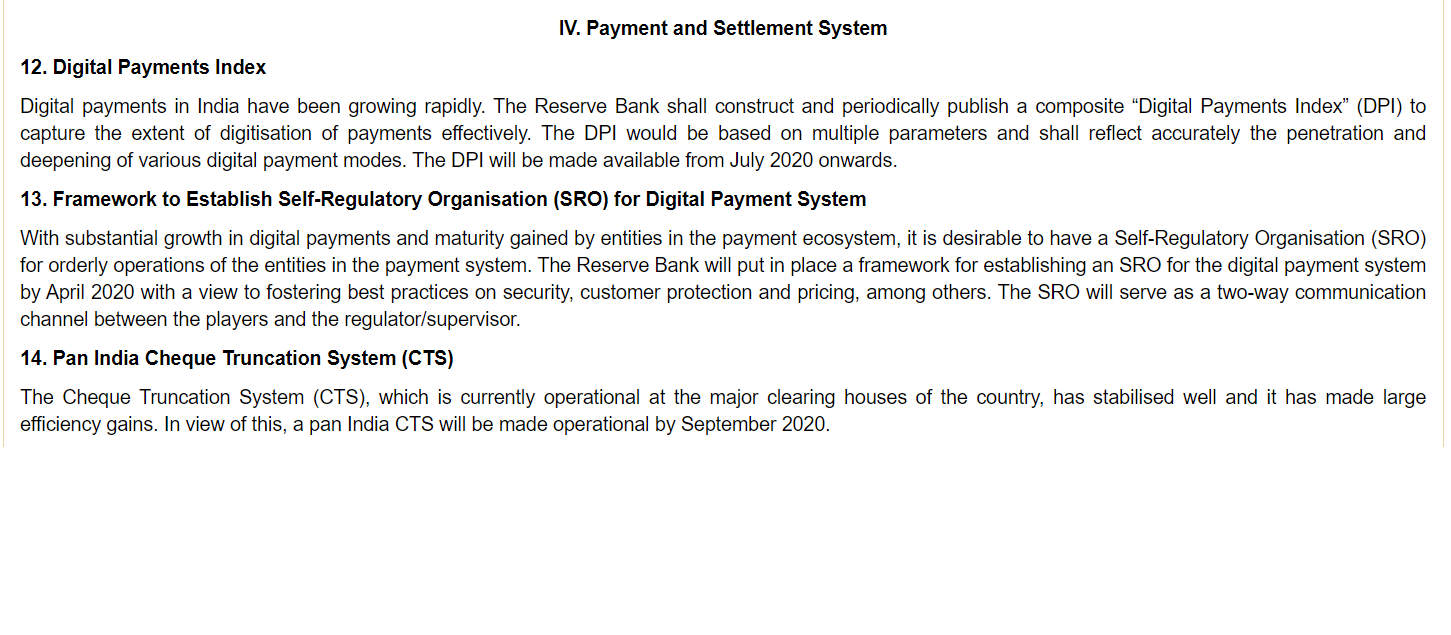

#CashlessConsumer Announcements from #RBI MPC

1. Allowing RRBs to enter merchant acquiring business

2. Digital Payments Index to be live from July 2020

3. Framework for establishing SROs in digital payments systens

4. Pan India Cheque Truncation System

They would then claim that incorrect details of the vehicles had been uploaded. The system would refund the money immediately into the desired bank account

Mumbai gang siphons off Rs 20 crore with 4,000 fake #FASTag refunds

The cyber crime cell of the city crime branch busted a gang running an online fraud to siphon off crores.

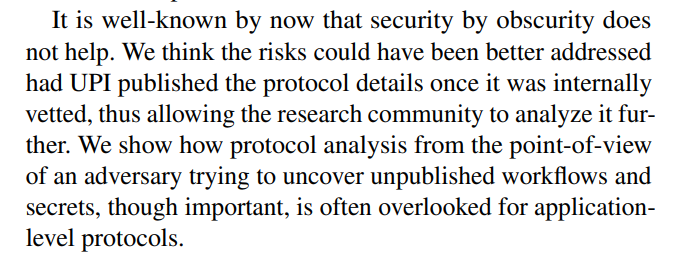

A global call out of #openwashing in #UPI by keeping specifications closed. This went on

@USENIXSecurity

#UPI A study of UPI Security by academia, does a total break down of UPI's security limitations on using device binding as source for one factor of authentication and exposes the vulnerabilities (Some fixed).

https://www.usenix.org/system/files/sec20summer_kumar_prepub.pdf

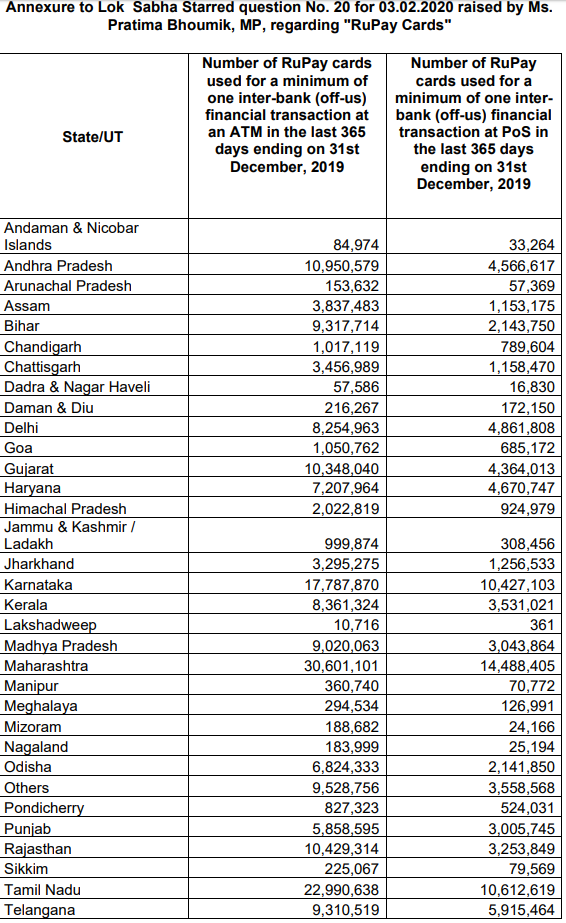

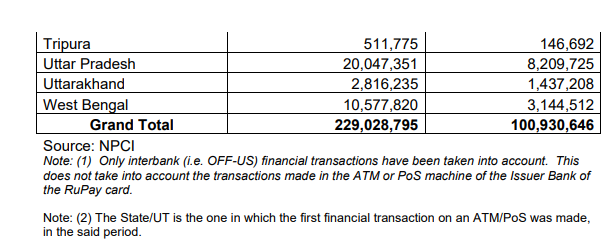

#CashlessConsumer #SansadWatch #RuPay YAU (OFF-US) ATM / PoS.

ATM is at 38.71%

PoS is at 17.06%

http://164.100.24.220/loksabhaquestions/annex/172/AU2191.pdf

http://164.100.24.220/loksabhaquestions/annex/173/AS20.pdf

#CashlessConsumer #SansadWatch Questions about #RuPay asked in parliament and reply by DFS / MoF. Note that questions largely remained same!

Finance Minister Nirmala Sitharaman said the government would monetise 12 highways, spanning over 6,000 km, before 2024.

https://www.bloombergquint.com/business/budget-2020-government-to-monetise-6000-km-of-highways

Payments nationalism is affecting innovation.

https://www.paymentssource.com/opinion/payment-nationalism-is-harming-innovation

School bus operators seek relief from #FASTag payments https://www.thehindu.com/news/national/tamil-nadu/school-bus-operators-seek-relief-from-fastag-payments/article30687456.ece

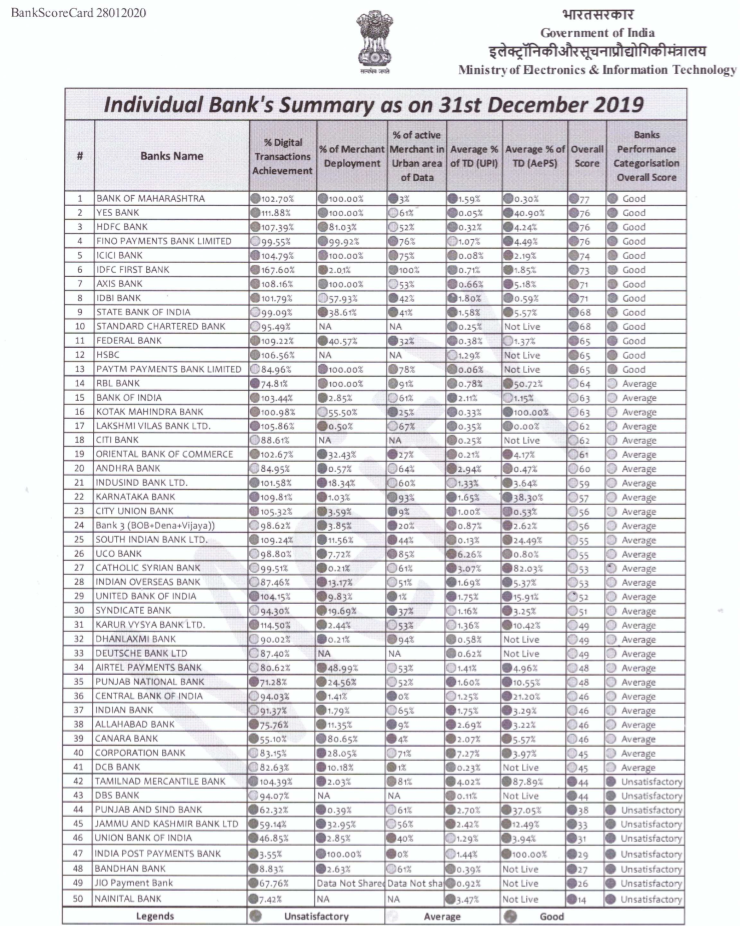

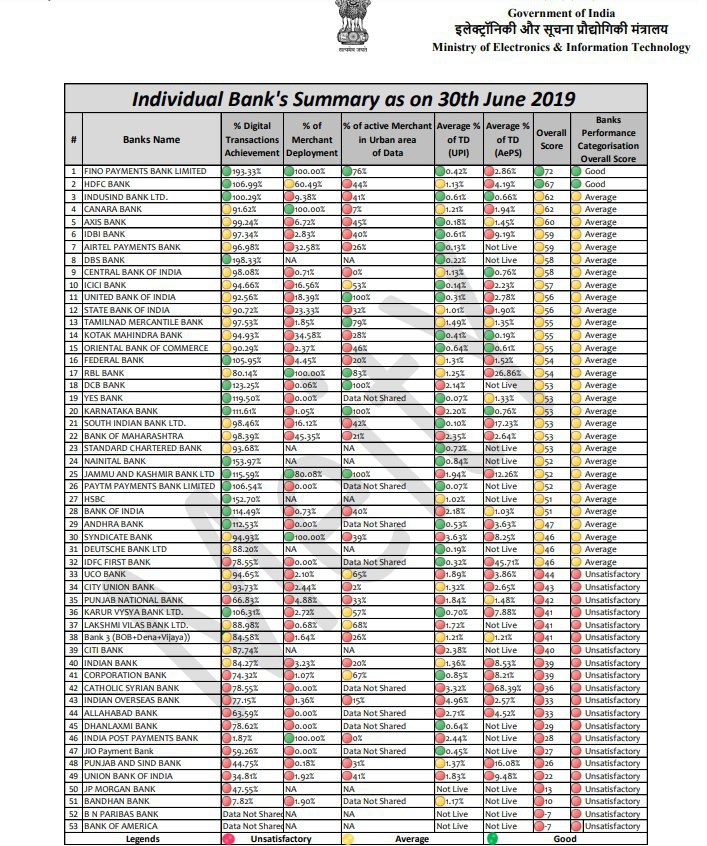

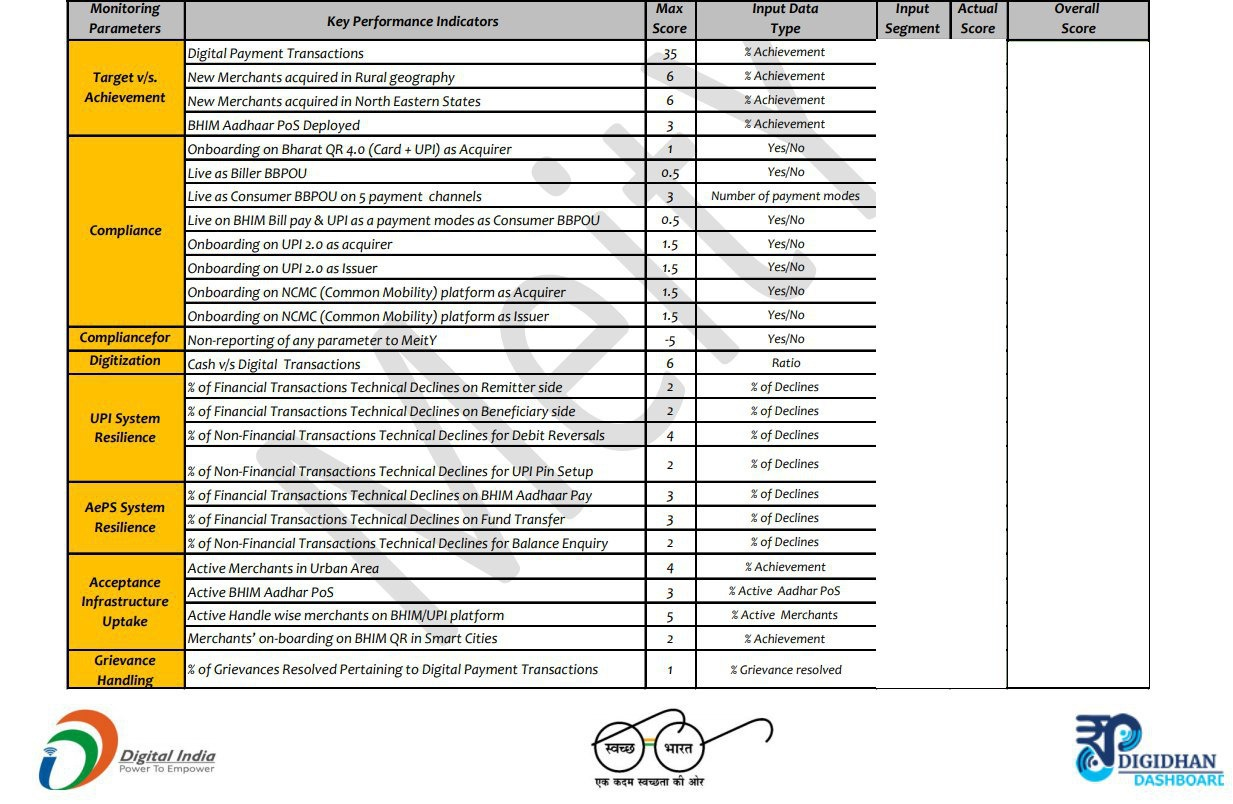

Reply PDF for those who want to have detailed look https://pdfhost.io/v/1Dh+iDmM_MeityDigiDhan_Reply_Dec_2019pdf.pdf

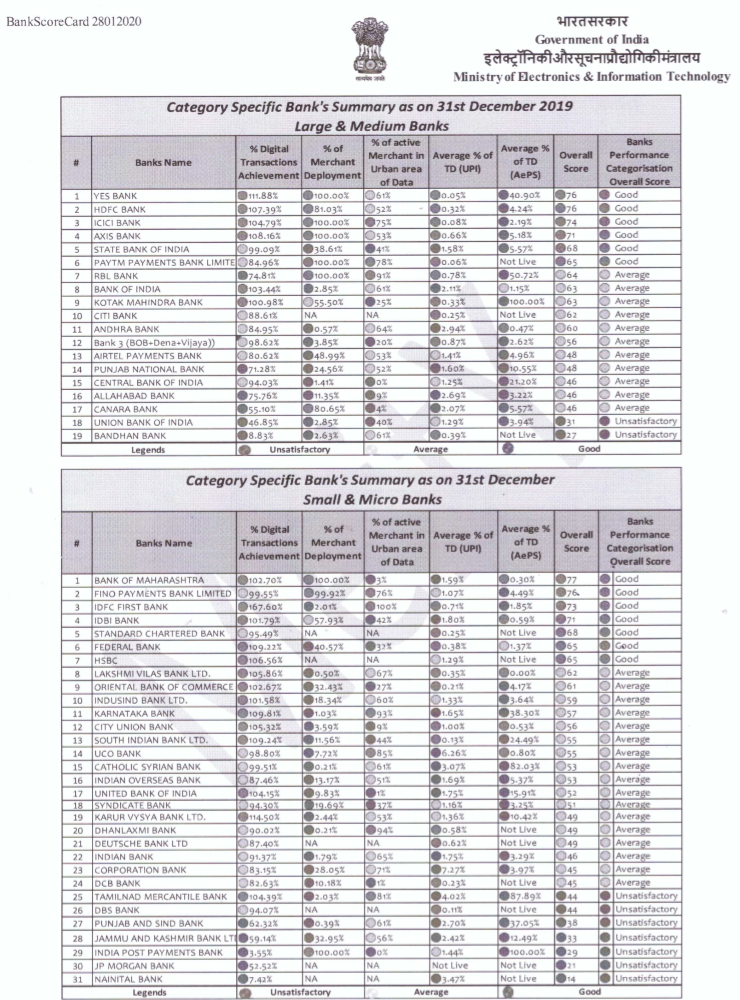

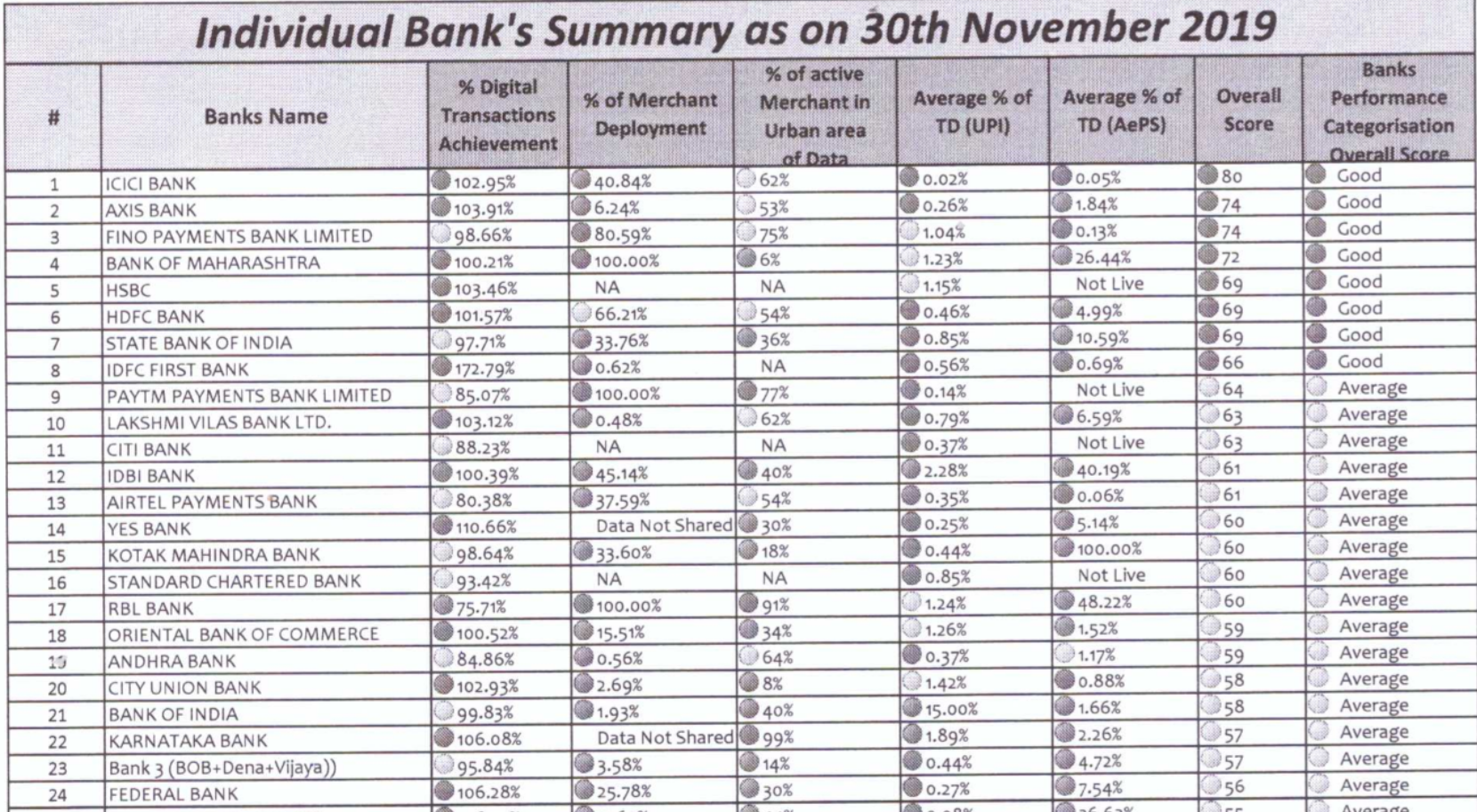

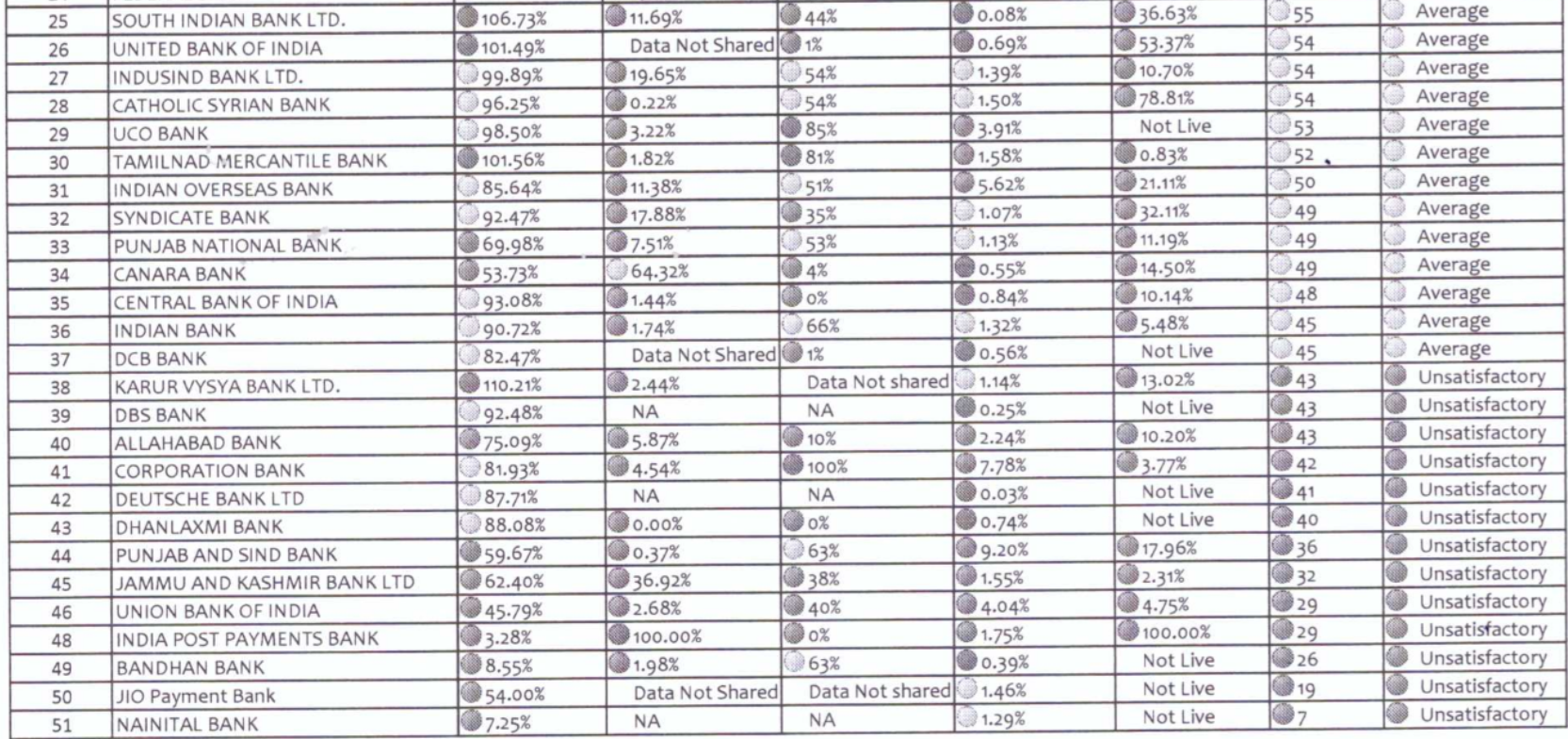

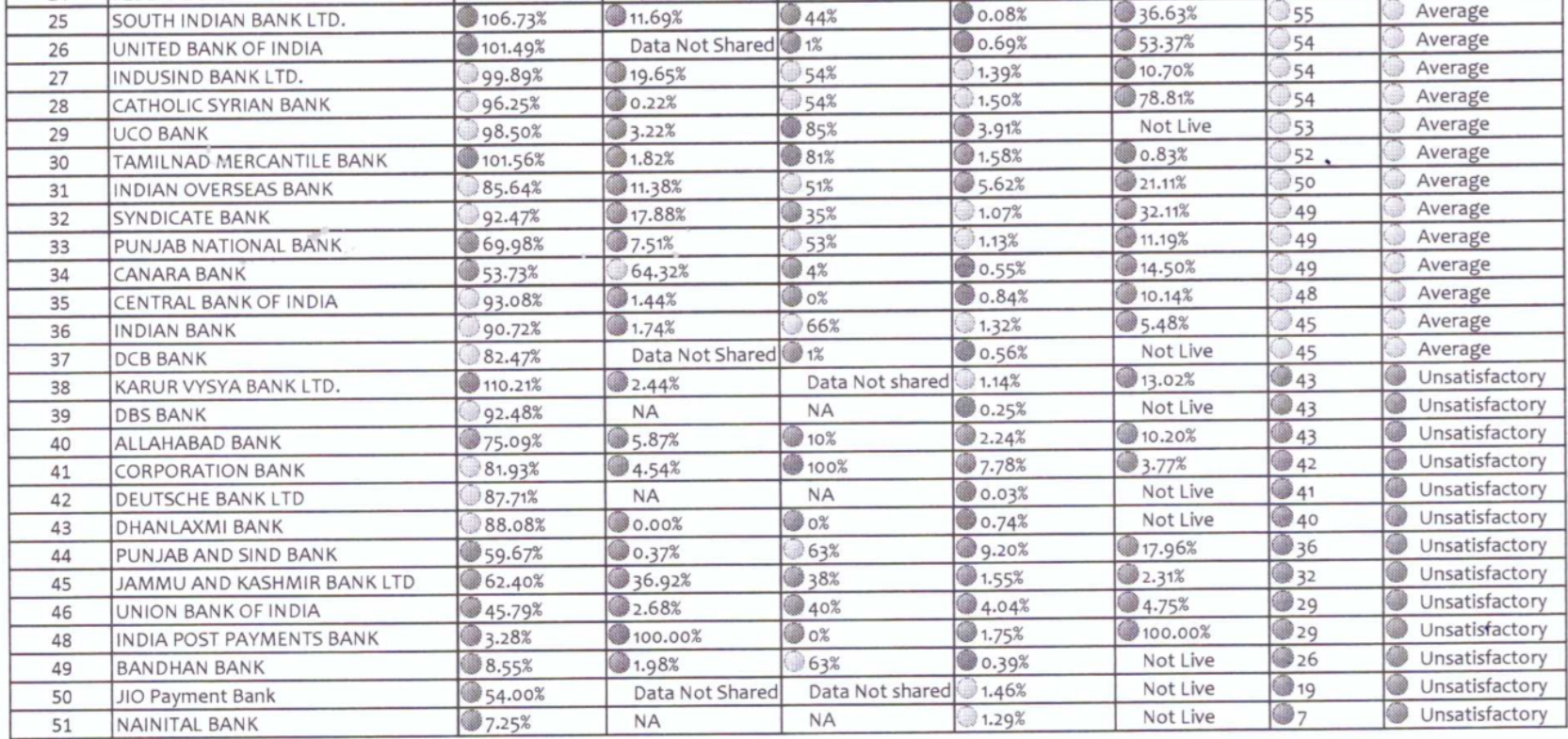

#CashlessConsumer #RTI #Opendata We asked Meity for their DigiDhan statistics tracker and they provided ranking of banks based on set of parameters to promote digital payments for December 2019

Nov 2019 https://twitter.com/logic/status/1207536258030784512

Mangaluru: Concession at tollgate only for vehicles equipped with FASTag

https://www.daijiworld.com/news/newsDisplay.aspx?newsID=666016

This is blatantly illegal act by #NHAI

Banks push #NPCI to remove #UPI charges (specifically switching fees in #ZeroMDR era) http://toi.in/HuzvKZ65/a24gk via @TOIBusiness

#CashlessConsumer PhonePe ATM violates Cash @ POS regulations, does not have regulatory approval. https://link.medium.com/61c3Kw6Ot3

RBI remains silent of regulatory omissions, fails to protect consumer.

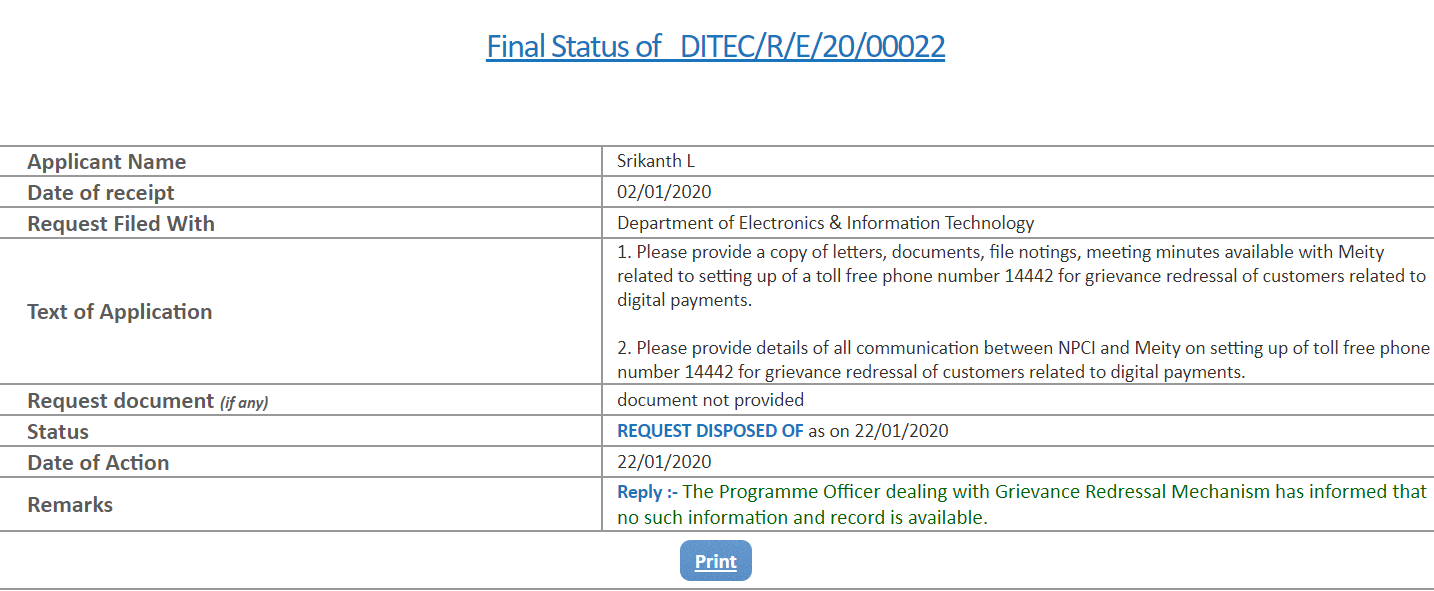

#CashlessConsumer #RTI We asked Meity about toll free on grievance redressal for customers of digital payments.

This makes the source based story short on facts. https://economictimes.indiatimes.com/news/economy/policy/government-to-set-up-helpline-for-e-payments-grievance-redressal/articleshow/59092280.cms

No wonder we don't have helpline. RBI in #NSFI has hinted this.

200 scuffles in three days at Gurugram toll plaza over #FASTag

https://m.tribuneindia.com/news/200-scuffles-in-three-days-at-gurugram-toll-plaza-over-fastag-28280

In major setback, #FASTag increases wait time by 29%

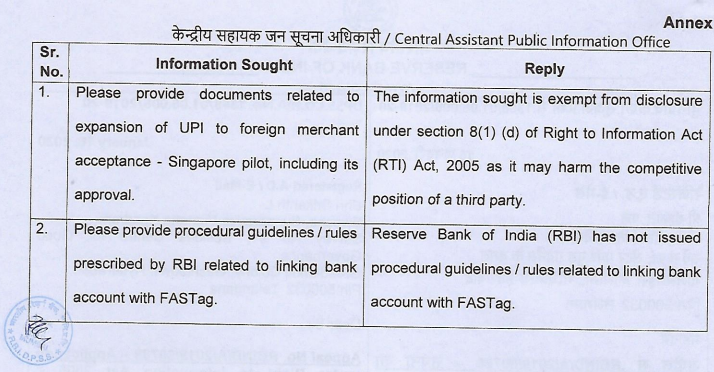

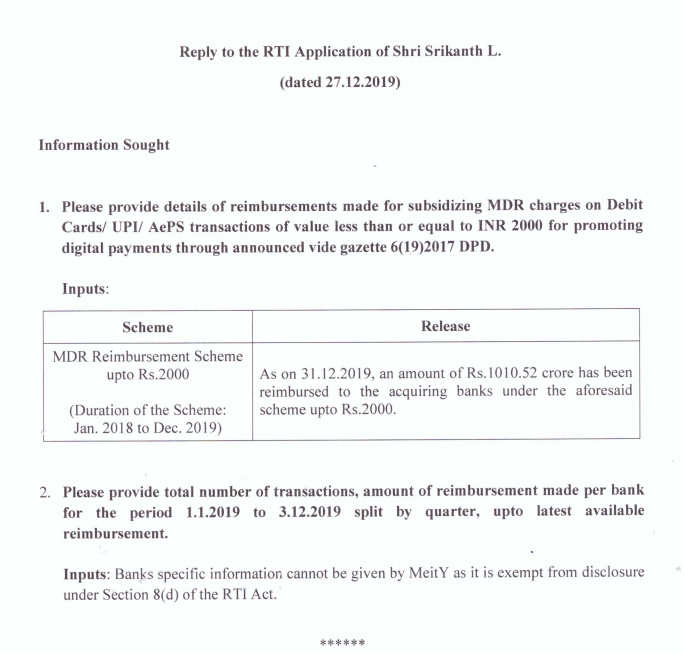

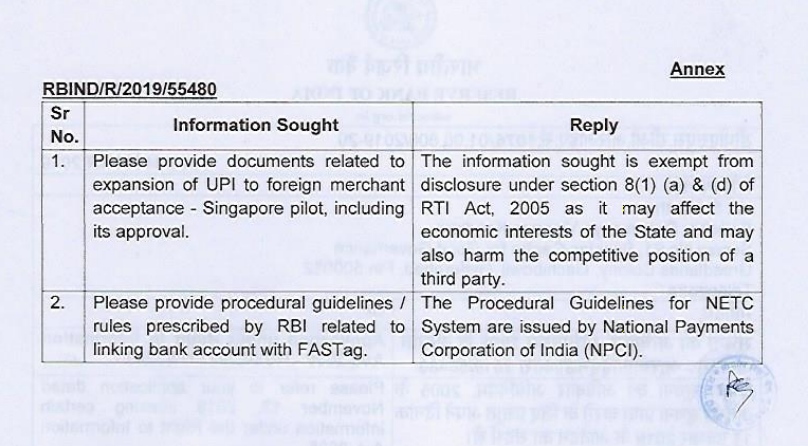

#CashlessConsumer #RTI -- After the appellate order, CPIO has responded saying RBI has not issued procedural guidelines / rules related to linking bank account with #FASTag

#CashlessConsumer RBI has issued 2 user friendly guidelines to increase safety of cards issued in India.

1. Limit international acceptance *at the time of issuance*

2. Provide options to users to restrict using sub limits, toggle contactless on/off etc

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11788&Mode=0

Knowledge/Seizure: Data, Debt, & the Parastate in Kenya

http://citapp.iiitb.ac.in/talk-by-kevin-donovan-university-of-edinburgh/

#Bangalore #Fintech folks, happening tomorrow 2:00 pm – 3:30 pm on 14 January 2020 at IIIT-B

Bengaluru taxi drivers hesitant about #FASTag

Centre shouldn’t rush to make #FASTag only mode of toll payment: Experts https://www.thehindubusinessline.com/news/centre-shouldnt-rush-to-make-fastags-only-mode-of-toll-payment-experts/article30532777.ece

Reco Operationalize a Common Toll-Free Helpline which offers response to the queries

pertaining to customer grievances across banking, securities, insurance, and pension sectors by March 2022

Reco Make the Public Credit egistry (PCR) fully operational by

arch 2022 so that authorised financial entities can leverage on he same for assessing credit

proposals from all citizens.

Reco Every willing and eligible adult who has been enrolled under the PMJDY (including the young adults who have recently taken up employment) to be nrolled under an insurance scheme (PMJJBY, PMSBY, etc.), Pension scheme (NPS, APY, etc.) by March 2020.

Reco Move towards an increasingly digital and consent-based architecture for customer onboarding by March 2024

Reco

Increasing outreach of banking outlets of Scheduled Commercial Banks /Payments

Banks/ Small Finance Banks, to provide banking access to every village within a 5 KM

radius/ hamlet of 500 households in hilly areas by March 2020.

RBI releases National Strategy for Financial Inclusion (NSFI): 2019-2024 https://rbidocs.rbi.org.in/rdocs/content/pdfs/NSFIREPORT100119.pdf

Some highlights

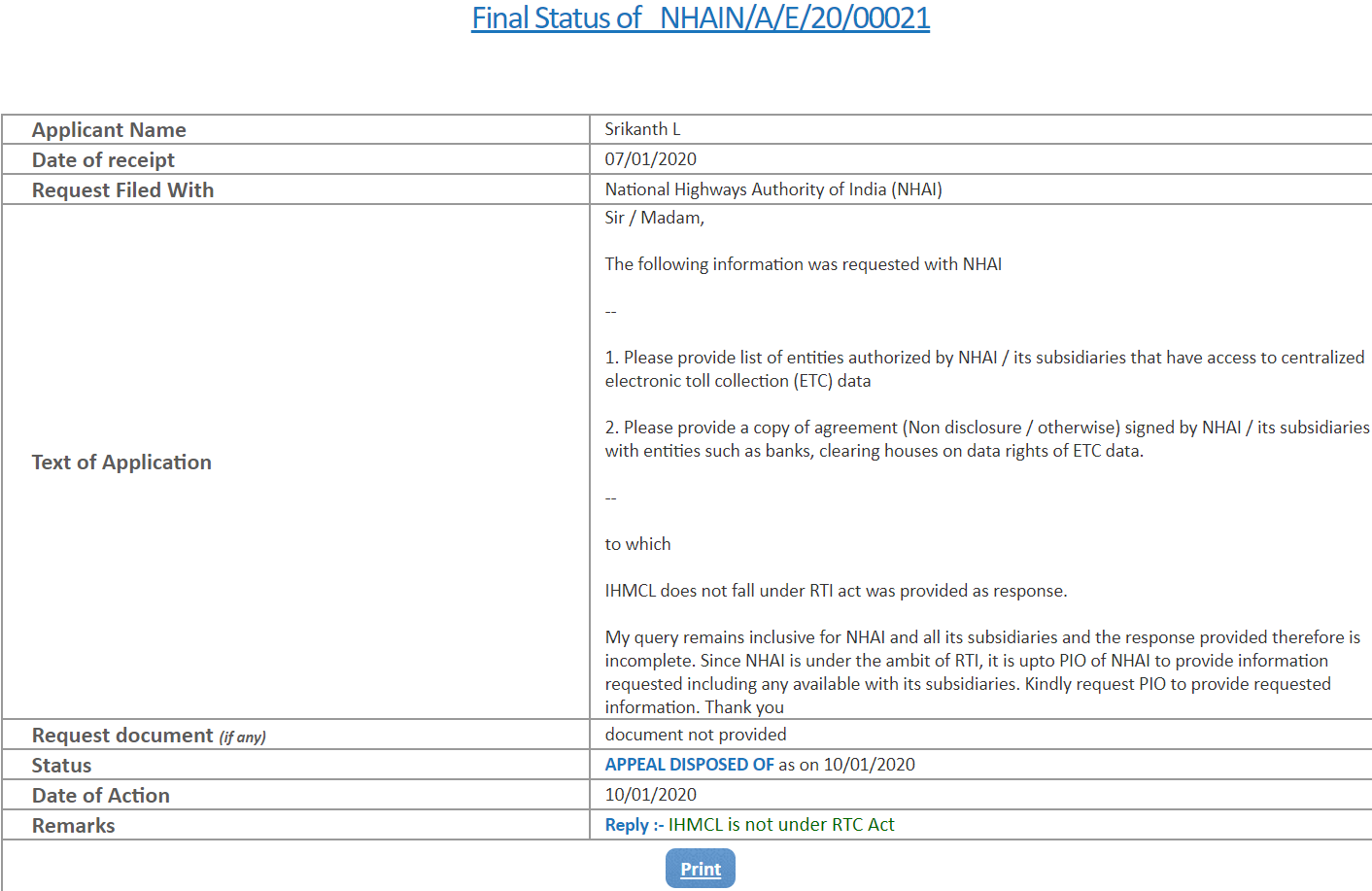

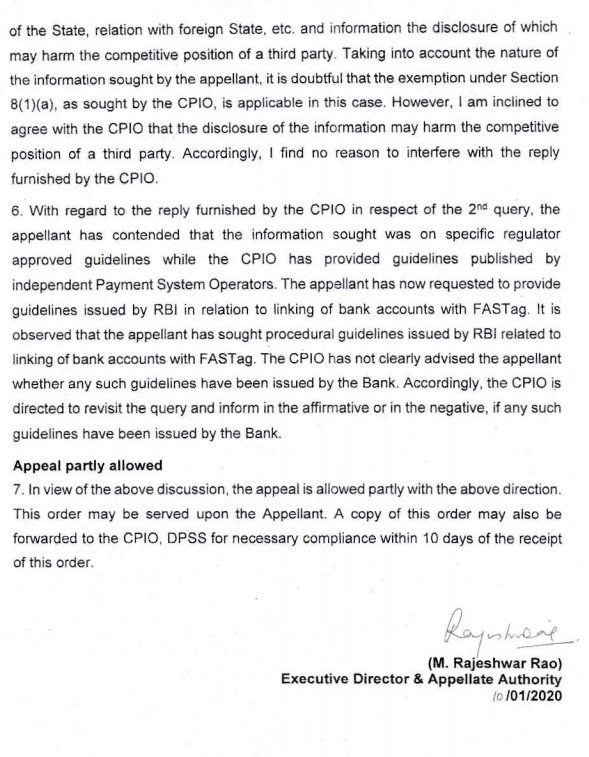

#CashlessConsumer #RTI That was fastest disposal of an appeal in 3 day and single line response saying IHMCL does not fall under "RTC Act". Whatever that is.

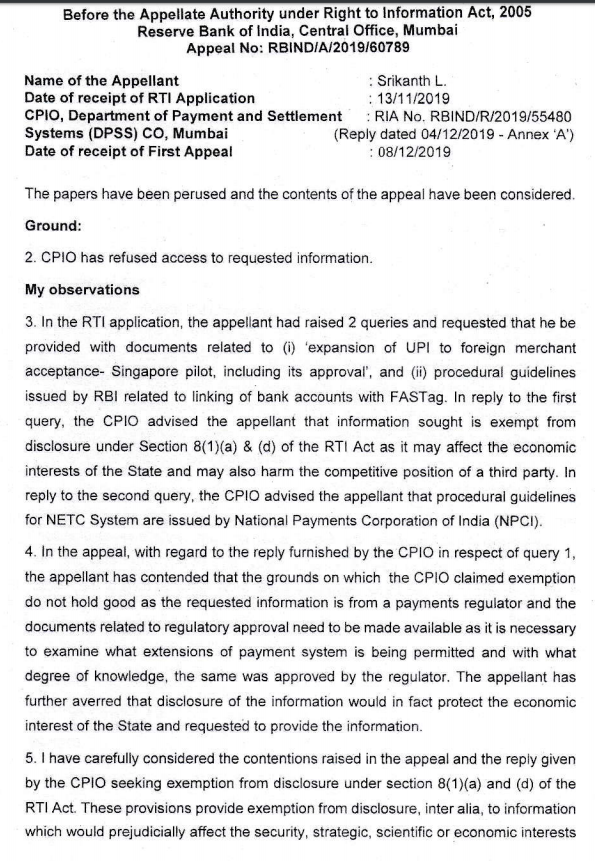

#CashlessConsumer appealed over the #RTI on information related regulatory approval of expansion of #UPI global acceptance and procedural guidelines issued by RBI on #FASTag. RBI response attached.

#CashlessConsumer #RTI We asked NHAI about details regarding data sharing agreements on #FASTag data and have got a reply citing IHMCL does not fall under #RTI Act

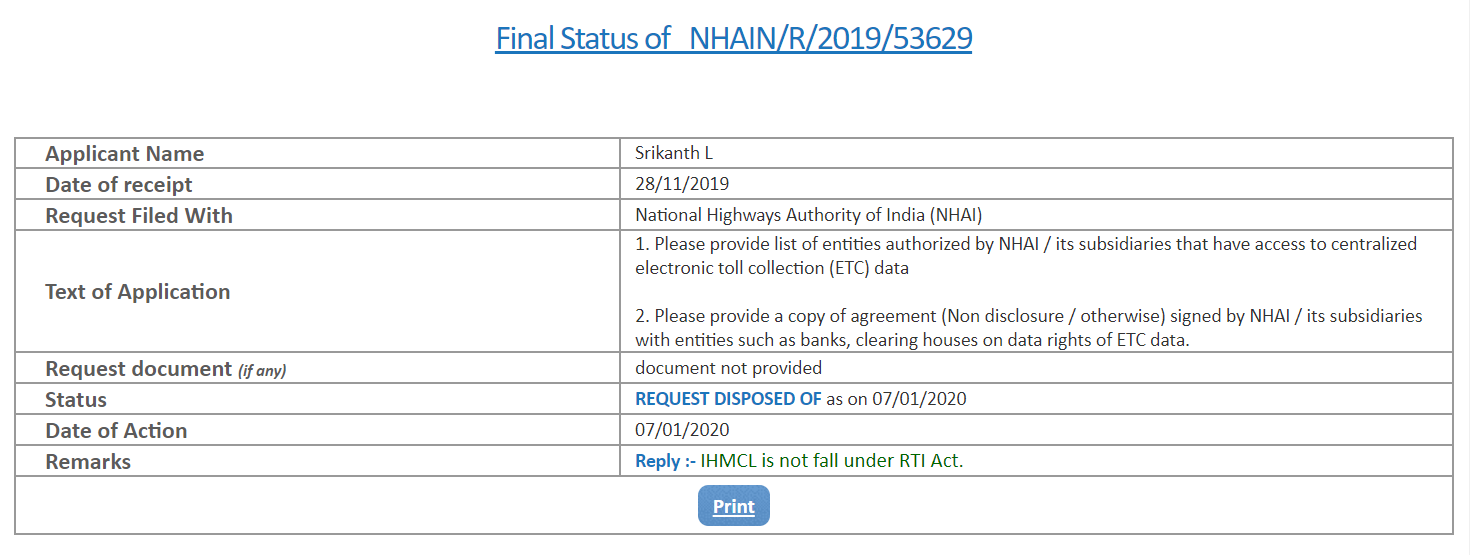

#CashlessConsumer #RTI We asked #Meity about the #MDR subsidy spends for calendar year 2019. - 1010 Crores

2018 - https://twitter.com/logic/status/1111548016991694848

₹ 1664 Crores was how much tax payer money was spent as subsidy to promote #DigitalPayments in 2018,2019. #CostOfPayments

#FASTag : Truck drivers use novel tricks to skip toll tax

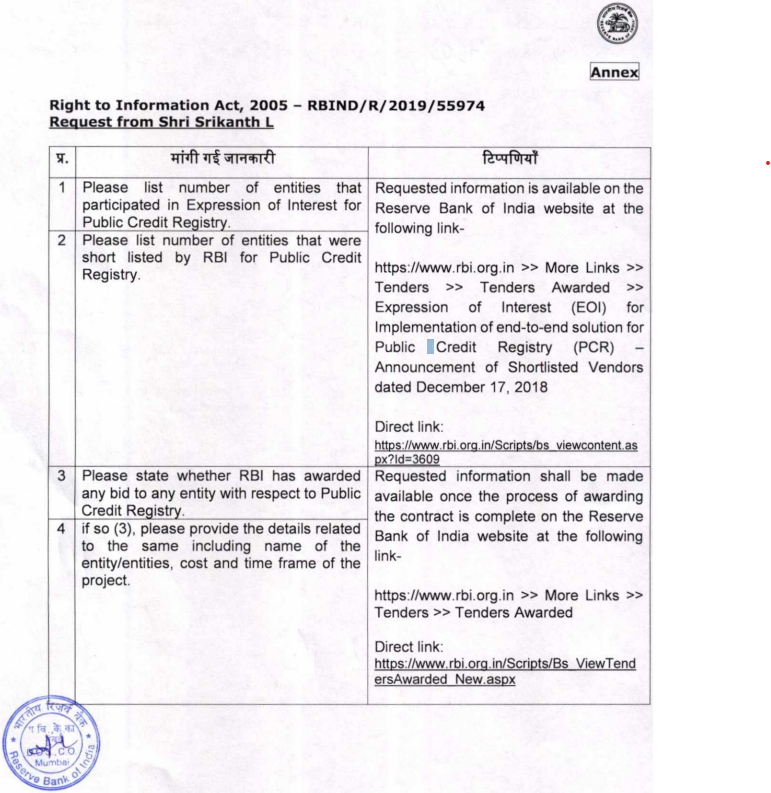

#CashlessConsumer #RTI We asked RBI about #PublicCreditRegistry

https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?id=3609 contains list of shortlisted entities after EoI.

The real game changer is NEFT going 24x7 and getting 0 rated silently. This will have unforeseen downstream effects.. Overall a bumpy start to 2020 for #DigitalPayments

Meity is well within its ability to stop subsidy, especially when we don't have data to show direct correlation / impact of the subsidy. We need more #opendata for evidence based policy making. There needs to investigation of transmission of this subsidy too for 2017-19.

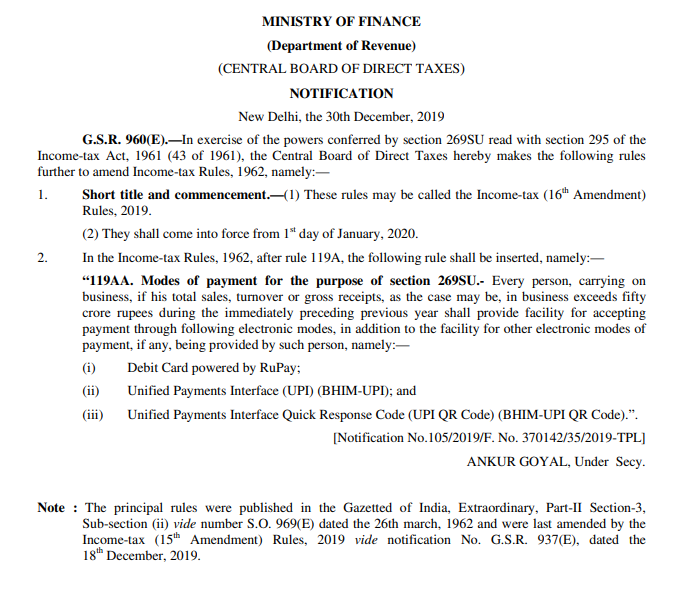

IMO, while 269SU can still be legal, the notification by CBDT on what constitutes "prescribed payment modes" is arbitrary, more so when it doesn't mention state run (regulator run) payment systems NEFT & RTGS and mandates specific pvt networks. Clear nepotism that is illegal

Infact, there is an anti-competitive element here and is being fought hard in #FedNow proposal in US as individual networks can never compete against regulator run network. I would agree too and NEFT can eat significant pie of these payment cos too!

While 269SU expands specific payment system acquisition availablity where it is mostly about those networks (and not general availablility),

Meity subsidy removal will hurt banks expanding to tier-3/4 where there isn't any money and 269SU barely applies

₹654 Crore was how much tax payer money was spent as subsidy to promote #DigitalPayments in 2018. 2019 figures will come up shortly.

That Meity might be justified to stop subsidy to industry (efficiency of which has not been studied, there have been complaints of subsidy not passed on to aggregators, leave alone merchants / consumers). But citing CBDT notification was incorrect.

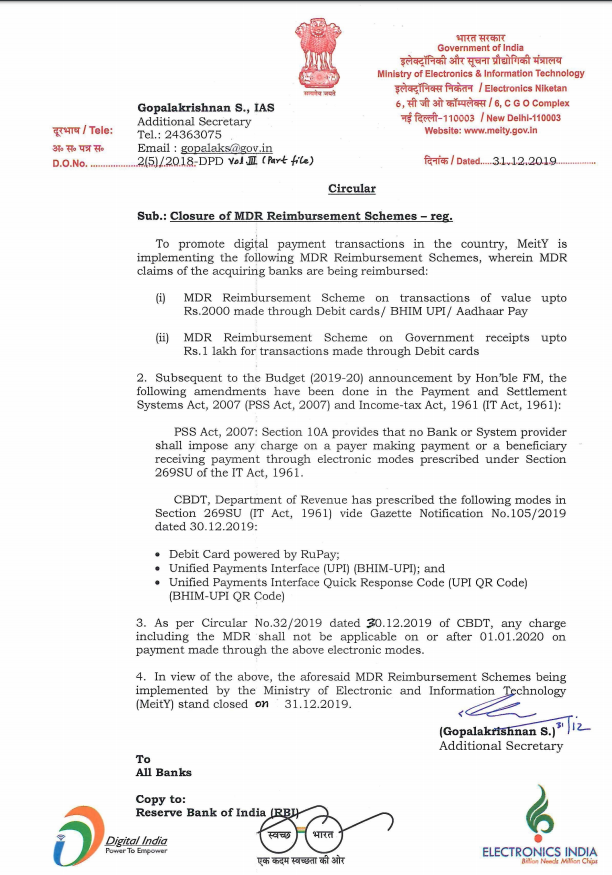

The 2nd announcement was stopping the subsidy meant for small merchants for low value transactions. Incidentally, this circular incorrectly linked the CBDT circular to imply #ZeroMDR on the modes to everyone (as against to only 269SU entities) and cancelled it.

But cost of goods / services remain same because they still accept using other modes where #MDR exists. So consumer doesn't get benefit and all that happens here is forced expansion of RuPay / UPI acquisition through Income Tax dept.

Secondly, since the #ZeroMDR applies only for these prescribed modes for these companies, they will not offer any special discount but instead get to profit extra, because banks now don't earn a revenue of these txns.

What this means is businesses for which 269SU applies, have to accept RuPay and UPI mandatorily.

This by itself is stupid, because not all business need to be consumer facing and why should they accept card / UPI electronic payments when they are B2B.

https://www.incometaxindia.gov.in/communications/circular/circular_32_2019.pdf - Link to notification.

269SU makes #ZeroMDR, but important to note its applicable only for large businesses and only for "prescribed modes"

Prescribed modes came via https://www.incometaxindia.gov.in/communications/notification/notification_105_2019.pdf

Facts first and opinions later.

On 30 Dec, FinMin clarified provisions in Finance Act relating to digital payments

1. 269SU meant for large companies > 50 Crores, mandating to accept "prescribed modes"

2. 271DB - Penalty for violating 269SU

#CashlessConsumer Much has been talked about #ZeroMDR amidst lot of panic based misinformation, half truths.

1.1.2020 marked 3 significant changes to payment industry all of which have deep implications. #Thread

#FASTag lacks grievance redressal in languages other than English and Hindu #ServeInMyLanguage

https://twitter.com/I_gopalakrisnan/status/1212588911123292160?s=20

#FASTag: Car at home but Rs 65 deducted at Manesar plaza, Haryana official to approach court https://indianexpress.com/article/cities/chandigarh/fastag-car-at-home-but-rs-65-deducted-at-manesar-plaza-haryana-official-to-approach-court-6195633/ via @IndianExpress

It also appears Aditya Birla Capital subsidiary has surrendered its in-principle approval that it had got last year.

FinSec AA (OneMoney) has been granted full license to operate. #NBFCAA

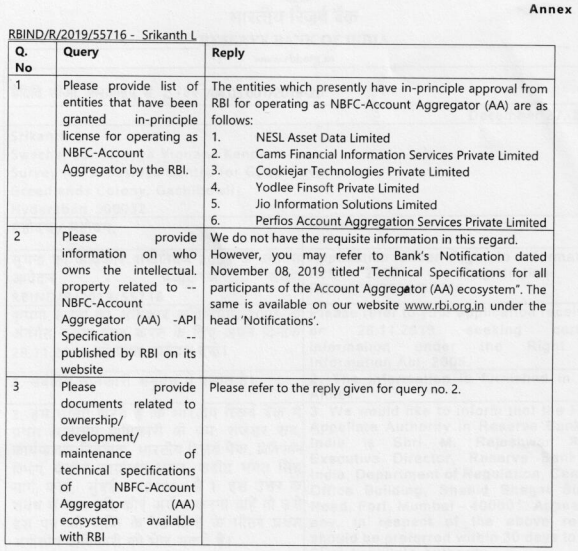

#CashlessConsumer #RTI We asked #RBI about #NBFCAA licenses and intellectual property, ownership, development and maintenance of NBFCAA specifications it published.

RBI doesn't have information on the latter. #Privacy #Consent #DataSharing

A recent survey, by Sabhikhi et al (2019), of Customer Service Centres in Jharkhand revealed that, on an average, customers pay about Rs 35 to withdraw Rs 1,000.

https://www.epw.in/engage/article/namesake-human-costs-digital-identities#.XgZJ1kJ4LjA.whatsapp

The "Subsidizing MDR charges on Debit Cards/BHIM UPI/AePS transactions of value less than or equal to Rs. 2000" / debit card subsidy regime ends by 31.12.2019.

#MDR on #DigitalPayments including #DebitCards apply wef 2020

https://www.meity.gov.in/writereaddata/files/gazette_notification_on_subsidizing_mdr_charges.pdf

Notice how no consumers were consulted by the committee and every bank has investments on digital payments and they get together to price cash.

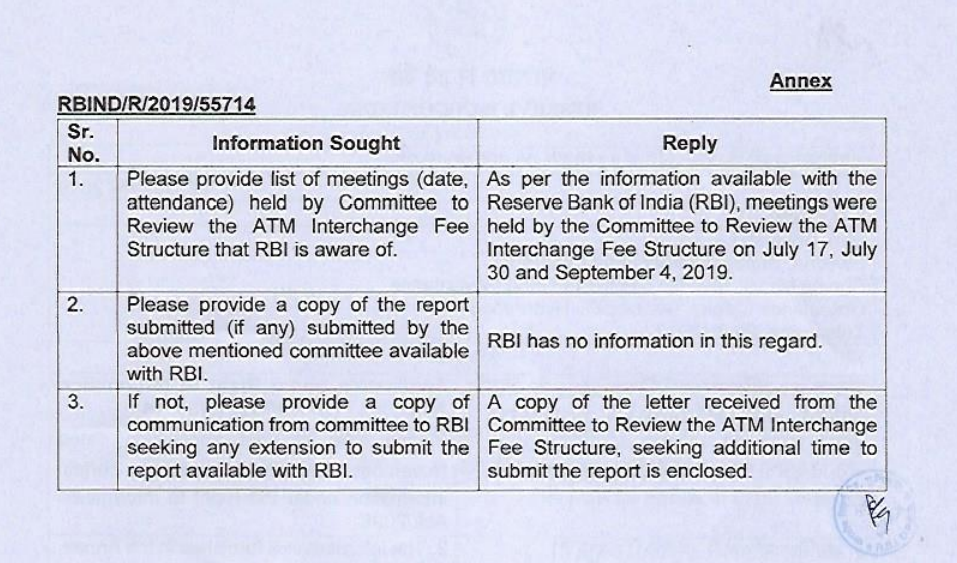

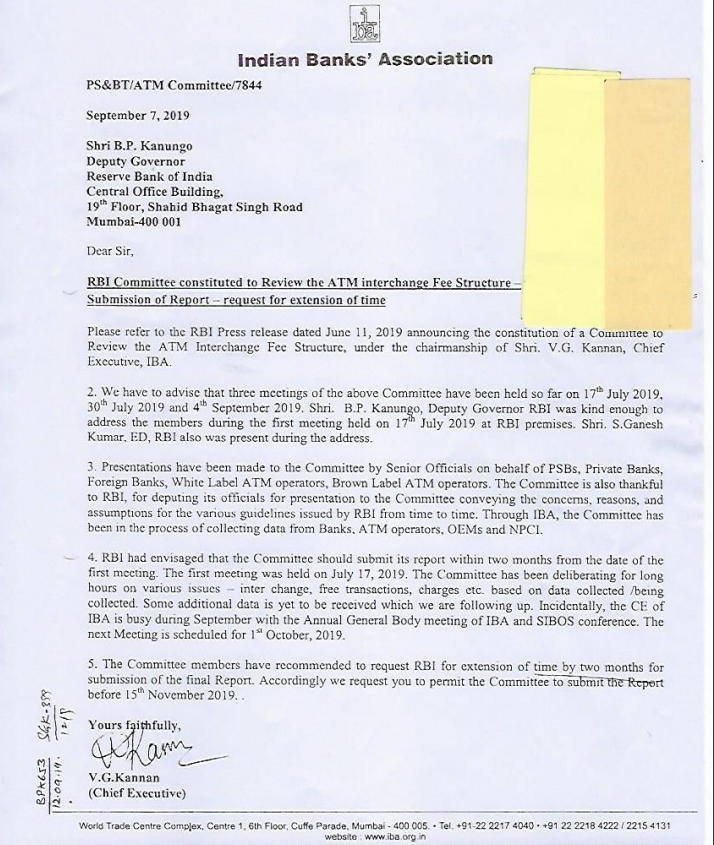

#CashlessConsumer #RTI We asked RBI about the #ATM Interchange pricing committee (whose report is due for some months now), its meetings and copy of report.

Extension was sought till Nov 15, word is we will soon have the report out.

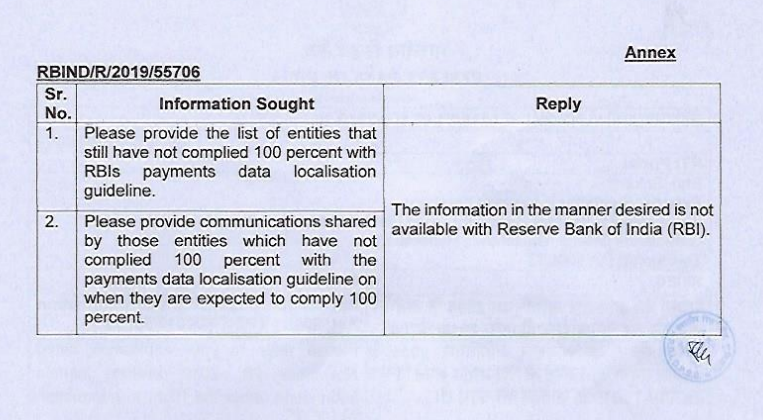

#CashlessConsumer #RTI We asked @RBI about #DataLocalisation compliance and have been denied any information citing "information in the manner desired is not available" with RBI

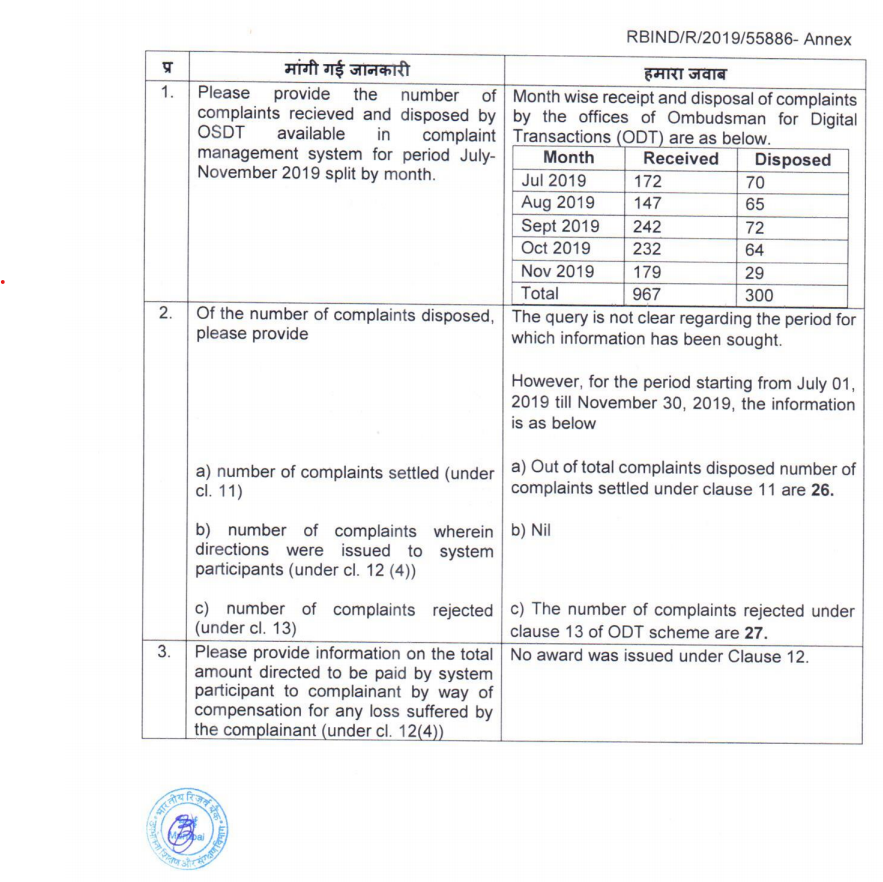

#CashlessConsumer #RTI We asked RBI@twitter.activitypub.actor some data on Ombudsman Scheme for Digital Transactions (OSDT)

Internet shutdown leaves UP at a net financial loss | ETtech https://tech.economictimes.indiatimes.com/news/internet/internet-shutdown-leaves-up-at-a-net-financial-loss/72962448 #KeepItOn #InternetShutdown

Hardlook: Teething troubles, switch to #FASTag not fast enough https://in.news.yahoo.com/hardlook-teething-troubles-switch-fastag-205804132.html?soc_src=social-sh&soc_trk=tw via @YahooIndia

To compare, the following was June 2019 data for the same and their scoring criteria (which goes beyond PoS deployment, UPI, AePS). There are multiple issues that this data tells, but kudos for Meity for tracking this. They should have dashboards public

#CashlessConsumer #RTI #Opendata We asked Meity for their DigiDhan statistics tracker and they provided ranking of banks based on set of parameters to promote digital payments.

Double whammy for citizens, thanks to #FASTag glitches https://punemirror.indiatimes.com/pune/cover-story/double-whammy-for-citizens-thanks-to-fastag-glitches/articleshow/72627251.cms via @ThePuneMirror

How Visa is looking to replace POS machines with this technology | ETtech https://tech.economictimes.indiatimes.com/news/technology/how-visa-is-looking-to-replace-pos-machines-with-this-technology/72726199

#FASTag: Will Datafication of India’s Tolls Boost Highway Development? https://thewire.in/political-economy/fastag-will-datafication-of-indias-tolls-boost-highway-development

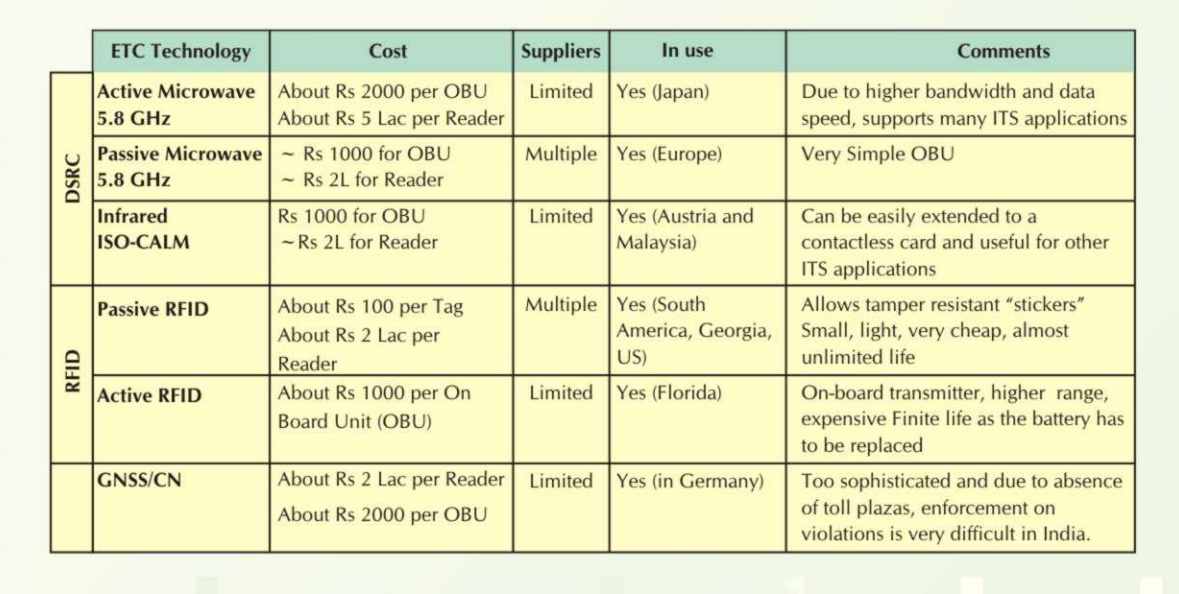

If you see instances like #FASTag cloned, that is because of the technology choice that preferred cost over other things like security in deciding the tech approach. The idea of KYC is to let fraud happen and identify using it. From 2010 NandanNilekani ETC Commitee report

New deadline not helping shift to #FASTag in Karnataka: NHAI http://toi.in/ioGlVb/a24gk via @timesofindia

Highways ministry urges #RBI to exempt #FASTag from KYC norm http://toi.in/qIDOvb/a24gk via @timesofindia

Painstaking path to #FASTag exemptions https://m.timesofindia.com/city/gurgaon/painstaking-path-to-fastag-exemptions/amp_articleshow/72391430.cms

#CashlessConsumer #RTI We asked #RBI about expansion of #UPI and #FASTag procedural guidelines. Appeal shall be filed.

@sankarshan @anivar The transaction on person A showed a ybl VPA. Mappers are free search APIs on all NPCI infrastructure and it simply doesn't want to understand what privacy is

#FASTag #CashlessConsumer #Awareness ஃபாஸ்டேக் திட்டம் பற்றி @logic உடன் ஒரு உரையாடல்.

https://castbox.fm/channel/id2486799

#PodAlert We are starting a channel on all things digital payments *for consumers*. Inaugural episode on FASTag in Tamil

https://www.thehindu.com/news/cities/bangalore/fastag-deadline-extension-offers-relief-to-ksrtc-bmtc/article30118487.ece FASTag deadline extension offers relief to KSRTC, BMTC

"National Highways Authority of India (NHAI) officials said it was not that there would be 100% compliance even with the new deadline"

#NPCI A Public Body? CIC Asks Again if #UPI Is A Monopoly; MD Denies https://www.thequint.com/tech-and-auto/cic-rti-npci-a-public-authority-upi-a-monopoly-dilip-asbe-denies

4,170 KSRTC buses enter 81 toll plazas daily in Karnataka, Tamil Nadu, Kerala, Andhra Pradesh, Goa, Maharashtra and Telangana. The corporation is paying Rs 6 crore month as toll charges and no KSRTC bus has #FASTag

Here is the link to Senate oversight committee discussing in detail about toll interoperability. If only parliamentary discussions were held before making #FASTag mandatory.

#CashlessConsumer We spoke to @digitaldutta about #FASTag on a new @SunoIndia_in show - #CyberDemocracy

Tune in to https://www.sunoindia.in/cyber-democracy/fast-tag-conundrum/ to listen about #FASTag conundrum and how its impact on economy.

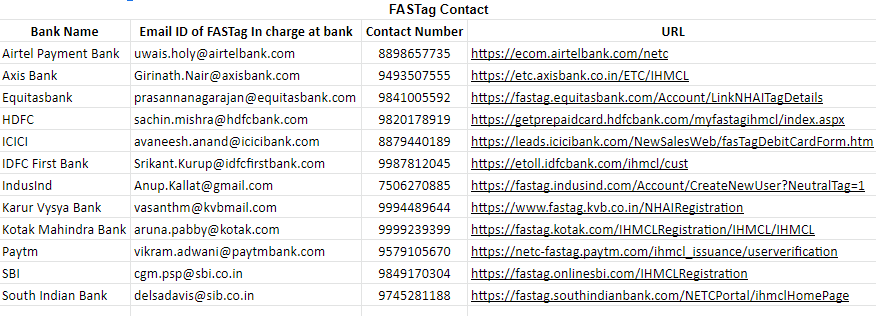

#CashlessConsumer If you are a #FASTag user and having troubles with support, please contact the respective in charges of bank. We have updated our #FASTag tacker.

https://docs.google.com/spreadsheets/d/12HlWnWfGoiBa2m14tpsUtWbdrSKN8zwGPo_BfL7ejRU/edit#gid=10215609

FIS India penalised for 'flouting' service conditions in managing ATMs - ETtech

The bank is also not expected to renew its contracts with FIS for the next 10 years, the sources added, potentially causing a massive business loss fo..

Long wait at #FASTag lane, say motorists

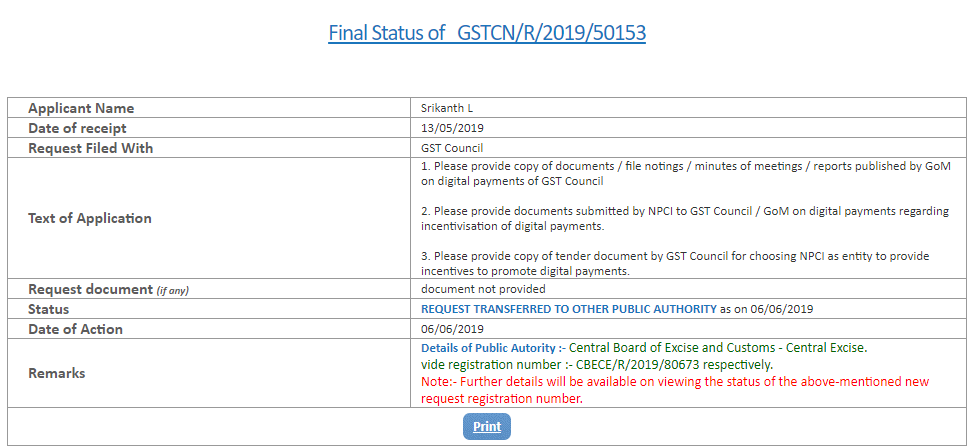

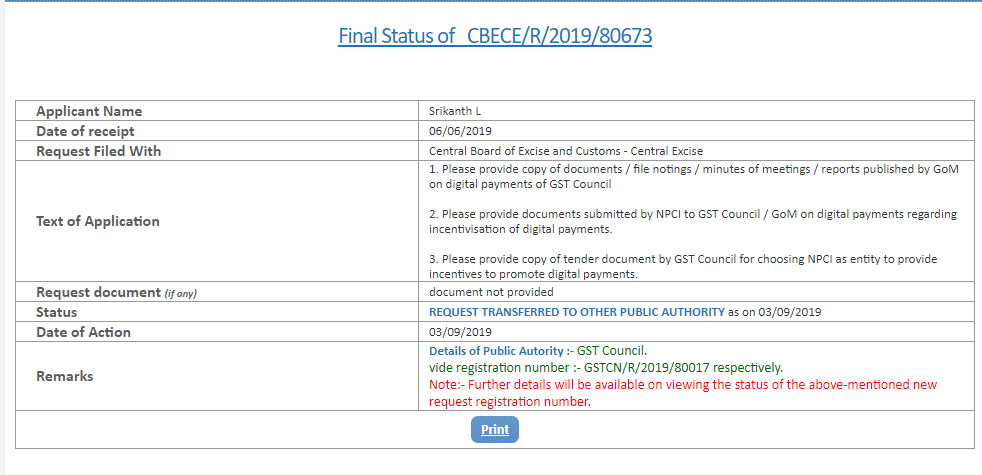

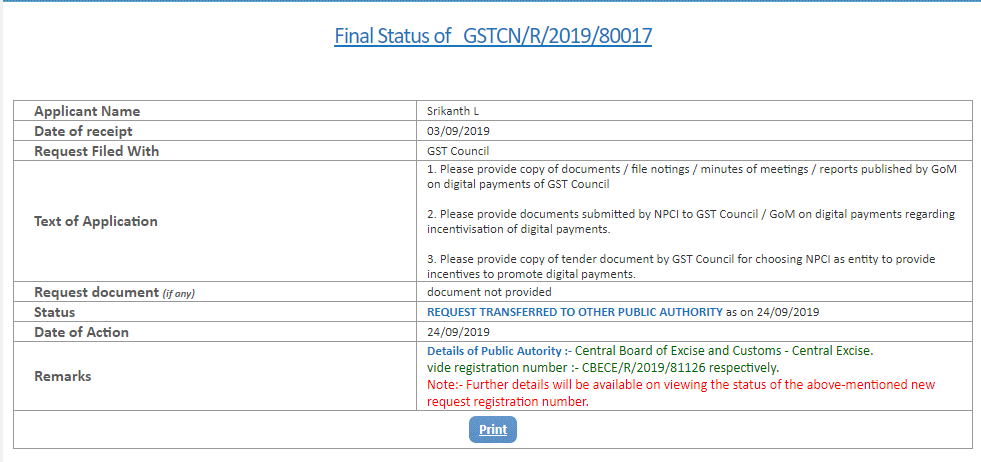

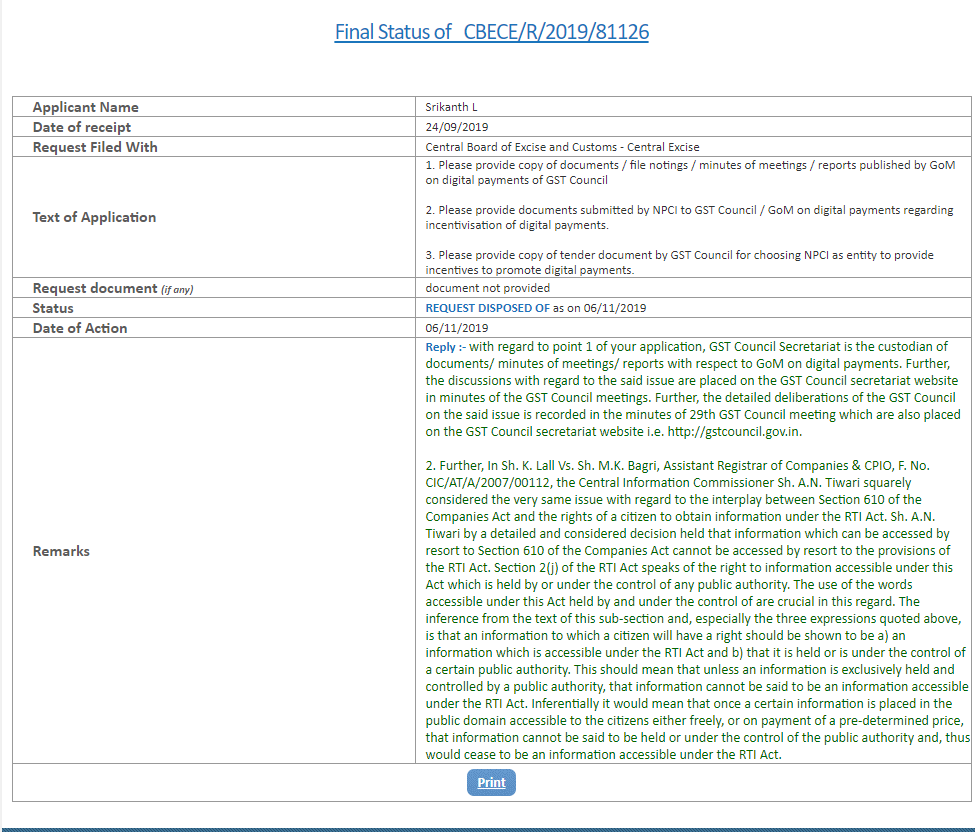

#CashlessConsumer asked GSTN about #DigitalPayments incentive scheme, there was a nice little throwball between GST Council and CBEC before they finally replied (only denying under a complicated reasoning). Appeal shall be filed. #RTI

#CashlessConsumer has been interesting in studying the #Technology behind payments. If API specifications, messaging #Standards interest you, we have started a library here. Do suggest on how to expand the collection.

We have been interesting in studying the technology behind payments. If API specifications, messaging standards interest you, we have started a library here. Do suggest on how to expand the collection. #CashlessConsumer #Technology #Standards

#FASTag: Can you 'Fastag' around India from Dec 1? TOI finds out -

https://timesofindia.indiatimes.com/india/can-you-fastag-around-india-from-dec-1-toi-finds-out/articleshow/72082328.cms

December 1 deadline nears but #FASTag hiccups at NH toll plazas persist

Change scope of 'full and direct regulations' for payment aggregators and gateways: @cashlessconsumer to RBI

https://www.medianama.com/2019/11/223-rbi-payment-aggregators-gateways-cashless-consumer-submission/

@medianama on our response to RBI on draft paper on #PAPGRegulation

Transactions using BHIM UPI made in Singapore, full launch in 2020 https://www.medianama.com/2019/11/223-bhim-upi-singapore/

".. this could be a pilot for enabling what Nilekani had said, hinting at the creation of bilateral digital payment corridors" via

BHIM app to go global. Singapore launch this week

The project is being jointly developed by National Payments Corporation of India (NPCI) and Network for Electronic Transfers (NETS) of Singapore #UPI

#CashlessConsumer #Policy Updated the #PAPGRegulation tracker with NASSCOM's response. https://www.cashlessconsumer.in/post/policy-regulating-papg-disc/

@noorul it depends on which system it is. At a very generic level, there are very few privacy friendly payment systems, but they do exist

Run up to cashless toll tax: NHAI urges people to download #FASTag for smoother journeys

https://indianexpress.com/article/india/run-up-to-cashless-toll-tax-nhai-urges-people-to-download-fastags-for-smoother-journeys-6107534/

Officials maintained that response from the general public has not been encouraging which has led to many problems. They maintain that people are still sticking to many misconceptions regarding the move.

Mumbai Fintech Hub, FCC unveil India FinTech Festival

https://ibsintelligence.com/ibs-journal/ibs-news/mumbai-fintech-hub-fintech-convergence-council-announce-india-fintech-festival/

Codashop partners with Paytm payment gateway to drive digital gaming penetration in India

https://www.outlookindia.com/newsscroll/codashop-partners-with-paytm-payment-gateway-to-drive-digital-gaming-penetration-in-india/1657321

SEBI extends second phase of #UPI implementation for retail investors till March 2020

@2talkon It never required Aadhaar. But think of central payments platform that asks for a *lot* of personal data. Its a trade off people need to make for convenience because there is no alternative for instant payments in this country.

We at cashlessconsumer have been engaging with stakeholders, industry groups, RBI to learn these problems, represent consumer interest. You can follow our work at https://www.cashlessconsumer.in

We will soon enough have a rights respecting payments infrastructure as public good. #Hope

I spoke about this issue in detail a while back - https://invidio.us/watch?v=QraT867Lg6U for those who have 20 minutes. There is also other side to coin. How to solve for providing payments to billion people at lowest cost without drilling into their rights. Its hard problem

Remember RBI not only gatekeeps and provides friendly environment to maintain NPCI and its dominance, it also actively part of the ommissions. An incomplete laundry list https://twitter.com/logic/status/1056379063223279617 to maintain status quo and favour one lobby that are waiting to strip your privacy

NPCI all the while expanded centralizing more and more payments - with full support of RBI - centralizing all bill payments, toll collection, using the same rationale. All this is giving it a free hand to rich data - to a private entity without proportional accountability

NPCI mentioned in hearing saying it is not a monopoly. https://www.thequint.com/tech-and-auto/upi-not-monopoly-npci-not-controlled-by-rbi-dilip-asbe-md-rti-cic-hearing

Alt Truth world. Imagine twitter saying its not monopoly because there are multiple apps you can use to access Twitter.

A new case against it in CIC has been on for 2 years and full bench ruled in interim order saying "it is substantial of law"

https://www.thequint.com/news/india/should-npci-bhim-upi-come-under-rti-cic-refers-division-bench

The last time someone used #RTI to seek information, a CIC order judged the information need not be given. NPCI used that judgement to remove itself from #RTI framework. https://twitter.com/logic/status/797771302215917568

It is infact the second largest (possibly largest sanitized database) of Aadhaar with 65 Crore verified, bank linked entries.

That is lot of personal data centralized with one private entity. What are the checks and balances? Well, there was RTI and NPCI silently removed it.

Its not just ability to block, its also pretty active surveillance. Quite literally.

Irrespective of which app you use, NPCI has all the data when it comes to #UPI + Your (most) ATM txns + (most) cheque txns + Your Aadhaar + subsidies you got

The dangers of what Twitter did - lies with NPCI too. Ability to block anyone and not being answerable.

That's what they say -- Read https://twitter.com/logic/status/849162696264110080

It then launched #UPI - A mobile payments network for the smartphone era. One might ask what's the problem here? Lets list them out.

Friend of State monopoly - Imagine if govt said only twitter can exist? You can't be here. That's what NPCI is doing, while being a private entity

NPCI then went and launched IMPS - A mobile linked payment system that enables instant transfer. It then implemented NACH - National Automatated Clearing House - A payment system that processes standing instructions, recurring payments.

The first things they did was to centralize ATM networks under a single large network (NFS). This also enabled policy of minimum free transactions across any ATM. RBI then gave away cheque / ECS processing service to this entity and transitioned its assets to this private entity

So we have a state friendly private enterprise performing state's policy vision of democratizing payments in a market friendly manner. Centralization also enables network effects which further increases efficiency gains

Later, RBI showered its blessings on NPCI as a private, banks collective owned non profit to handle payments. Being a non-profit their mandate was to achieve lowest cost and centralization has inherent efficiency gains one can't ignore.

India traditionally had #RBI running payment systems NEFT and RTGS for payments. Card companies (Mastercard & VISA) entered later. All these are centralized payment systems. Lets rewind to 2000's. Payments in general (including ATM) were still available only to fraction, costly.

#Introduction We are a consumer collective focussed on digital payments based out of Indian closing tracking #paytech #fintech developments from a consumer perspective. You can know more about us on our website www.cashlessconsumer.in

@anivar @digitaldutta @pandayjyoti @logic are some members here. Toots by @logic on news, views, updates related to fintech (mostly India, but at times global)

https://www.medianama.com/2019/11/223-fintech-committee-report/ Analysis of recommendations of #FintechSteeringCommittee report via @medianama

| A delayed report that got little attention owing to timing of the release.

#UPI will replace cash in India, says CEO of NPCI @DilipAsbe@twitter.com

| We are still waiting for CIC order (judgement reserved) on RTI of NPCI.

RBI to submit WhatsApp's data localisation compliance report to SC soon. #UPI #WhatsappPay

| Some golden quotes from source on who is regulator of payments.

@Cosmobird The payments platform being blackbox also poses threat of blockade going unnoticed, but so far centralisation hasn't been abused yet, no guarantees on future though. We just saw Twitter getting captured and abuse unleashed after a decade.

@Cosmobird The payments platform doesn't pose algorithmic threats/bias. The problem with that being closed is lack of understanding of data flows which is crucial in privacy, data protection discussion.

The IPO allotment lottery is perfect candidate though

@Cosmobird SEBI even when it's under RTI denied responses of public consultation we sought on this matter. Appeal too was denied. Didn't have enough bandwidth to goto CIC. https://moneylife.in/article/public-comments-on-listing-process-using-upi-affects-economic-interest-of-india-sebi/55814.html

@Cosmobird We have been demanding the same for several months now. There used to be platform specification that was publicly available, that too is no longer being made public. CIC has completed hearings on applicability of RTI to NPCI and awaiting judgement anytime

#UPI system payments glitch: Sebi knocks on RBI regulated NPCIs door

https://www.business-standard.com/article/markets/sebi-in-talks-with-rbi-regulated-npci-over-glitch-in-payments-119110501894_1.html

If Twitter's policy of having mobile number public is problematic, entire #UPI support desk (among others) violate the ToS, but Twitter will only target selectively to silence critical voices.

Google Pay's scratch and win offer flies in the face of TN's lottery ban

RBI announces the opening of first cohort under the Regulatory Sandbox.

Themes for the first cohert include

1. Mobile payments including feature phone based payment services

2. Offline payment solutions

3. Contactless payments

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=48550

#RBI Ombudsman for Digital Transactions has disposed 44% digital payments related complaints since Jan 31

https://www.medianama.com/2019/11/223-rbi-ombudsman-complaints-disposed/

8 digital payment-related scams and how you can avoid them

https://economictimes.indiatimes.com/articleshow/71863864.cms #DigitalPayments

Tamil Nadu to meet December 1 deadline for #FASTag

#WhatsApp fallout: Govt flags risks to payments through social media companies #WhatsappPay #UPI

#CashlessConsumer is a consumer collective working on #DigitalPayments to increase awareness,understand tech,produce/consume data,to be a voice for consumers in policy of #paytech ecosystem with a goal of moving towards a fair cashless society. More http://cashlessconsumer.in

Knock Knock

#CashlessConsumer is on #mastodon and if you use it follow at https://freeradical.zone/@cashlessconsumer

Toots forwarded to @logic on Twitter for now.